Plug-in the formula above and fill in the form with your company’s information. Balance sheets are an inherently static type of financial statement, especially compared to other reports like the cash flow statement or income statement. Analyzing all the reports together will allow you to better understand the financial health of your company. Balance sheets can be used to analyze capital structure, which is a combination of your business’ debt and equity.

Balance Sheets are Static

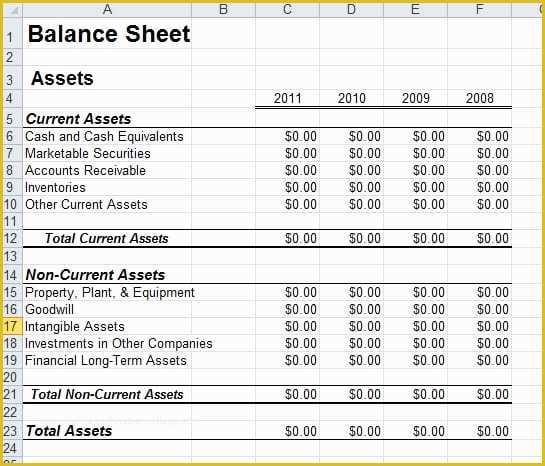

Use our guide to learn the importance of balance sheets for small businesses. Learn how to format your balance sheet through examples and a downloadable template. what are management skills and why are they important Balance sheets are usually prepared by company owners or company bookkeepers. Internal or external accountants can also prepare and review balance sheets.

Intangible Assets

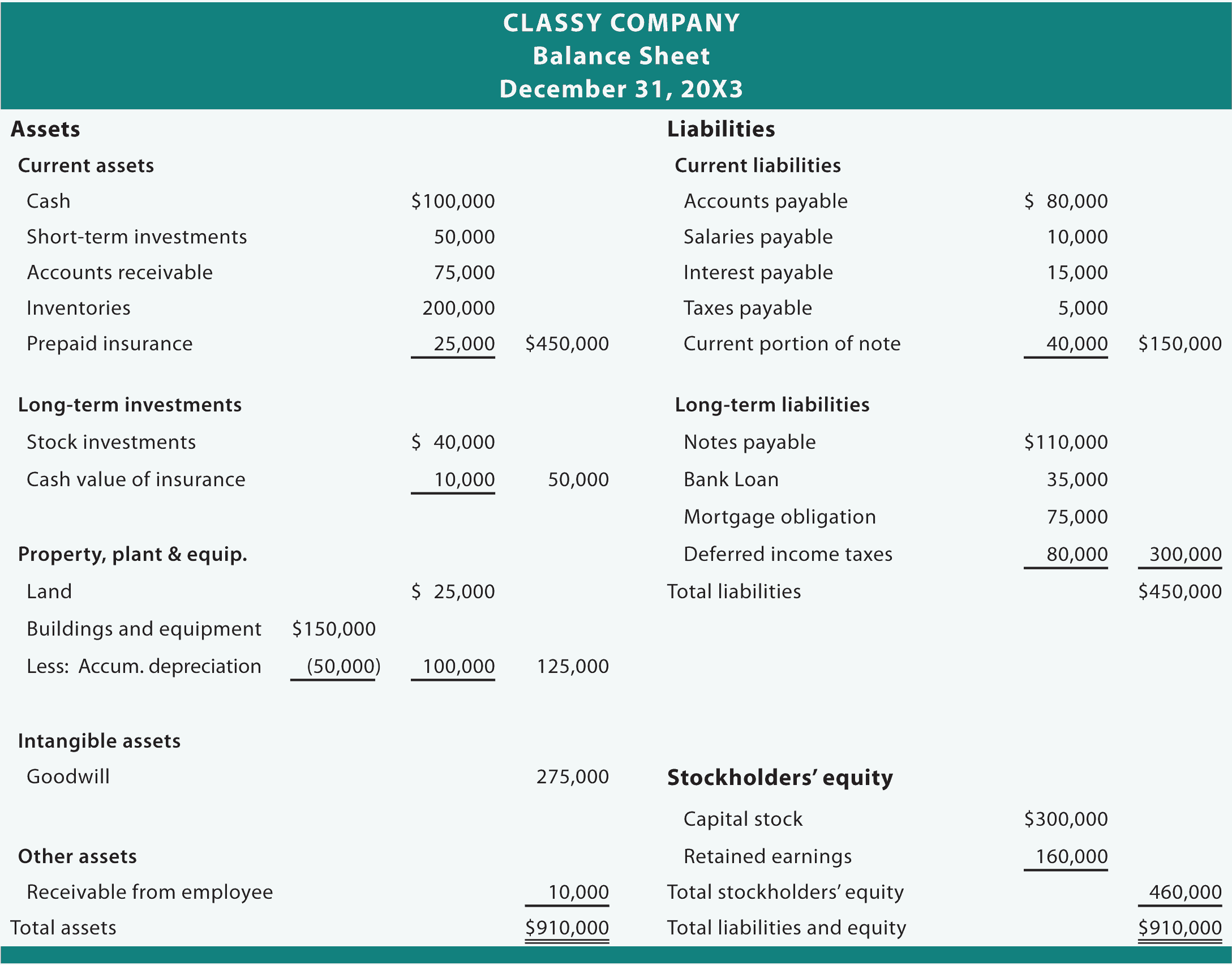

Balance sheets are invaluable when evaluating investment opportunities. By examining a company’s balance sheet, we can assess its assets, such as properties, equipment, and inventory, and determine their value and potential for generating returns. Here is an example of a basic balance sheet format most commonly used to track the company’s performance for a financial year. Do you want to learn more about what’s behind the numbers on financial statements?

Valuation of Assets

While this is very useful for analyzing current and past financial data, it’s not necessarily useful for predicting future company performance. By comparing your income statement to your balance sheet, you can measure how efficiently your business uses its total assets. For example, you can get an idea of how well your company can use its assets to generate revenue.

Experience seamless accounting with Zoho Books

Additional paid-in capital or capital surplus represents the amount shareholders have invested in excess of the common or preferred stock accounts, which are based on par value rather than market price. Shareholder equity is not directly related to a company’s market capitalization. The latter is based on the current price of a stock, while paid-in capital is the sum of the equity that has been purchased at any price. Investors and lenders also use it to assess creditworthiness and the availability of assets for collateral. A balance sheet is also different from an income statement in several ways, most notably the time frame it covers and the items included. Some financial ratios need data and information from the balance sheet.

Software vendors

- Balance sheets are usually prepared by company owners or company bookkeepers.

- They may be prepared internally by a mid-size private firm and then reviewed by an external accountant.

- Stock investors, both the do-it-yourselfers and those who follow the guidance of an investment professional, don’t need to be analytical experts to perform a financial statement analysis.

- Similarly, putting a specific value on intangible assets like brand value or intellectual property can be subjective and tough to determine.

- Some liabilities are considered off the balance sheet, meaning they do not appear on the balance sheet.

The total shareholder’s equity section reports common stock value, retained earnings, and accumulated other comprehensive income. Apple’s total liabilities increased, total equity decreased, and the combination of the two reconcile to the company’s total assets. Balance sheet refers to a financial statement which reveals the complete financial position of the company for a given date. A company’s balance sheet tells you the details of assets, liabilities and owners’ equity for the business.

Balance sheets should also be compared with those of other businesses in the same industry since different industries have unique approaches to financing. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. Shareholders’ equity will be straightforward for companies or organizations that a single owner privately holds.

A common characteristic of such assets is that they continue providing benefit for a long period of time – usually more than one year. Examples of such assets include long-term investments, equipment, plant and machinery, land and buildings, and intangible assets. The NERF measures available stable resources after financing fixed assets.

On the contrary, a company burdened with excessive debt or declining equity might raise concerns about its long-term viability. If the shareholder’s equity is positive, then the company has enough assets to pay off its liabilities. Once complete, we’ll undergo an interactive training exercise in Excel, where we’ll practice building a balance sheet template using the historical data pulled from the 10-K filing of Apple (AAPL). Conceptually, a company’s assets refer to the resources belonging to the company with positive economic value, which must have been funded somehow. It’s important to note that this balance sheet example is formatted according to International Financial Reporting Standards (IFRS), which companies outside the United States follow. If this balance sheet were from a US company, it would adhere to Generally Accepted Accounting Principles (GAAP).

This document gives detailed information about the assets and liabilities for a given time. By analysing balance sheet, company owners can keep their business on a good financial footing. While the financial statements are closely intertwined and necessary to understand a company’s financial health, the balance sheet is particularly useful for ratio analysis. It is useful for constructing trend lines to examine the relative changes in the size of different accounts. We’ve compiled free, printable, customizable balance sheet templates for project managers, analysts, executives, regulators, and investors.

Leave a comment

Your email address will not be published. Required fields are marked *