Financial Accounting Online Tutor, Practice Problems & Exam Prep

If a business buys raw materials and pays in cash, it will result in an increase in the company’s inventory (an asset) while reducing cash capital (another asset). Because there are two or more accounts affected by every transaction carried out by a company, the accounting system is referred to as double-entry accounting. Under the double entry accounting system, transactions are recorded through debits and credits. The effect of recording in debit or credit depends upon the normal balance of the account debited or credited. The double entry accounting system recognizes a two-fold effect in every transaction. Thus, business transactions are recorded in at least two accounts.

Balance Sheet and Income Statement

We’re going to call them current assets and current assets are going to be cash or anything that can be converted into cash in less than 1 year, okay? So typical things that we see in current assets are going to be cash. We’re going to see accounts receivable, money that’s owed to us by our customers, inventory, right? Merchandise that we’re selling, things like that, right? Things that we’re going to convert into cash pretty soon within 1 year. Compare that to our long term, our fixed assets, right?

- Thus, the resulting balances of both sides will always be equal.

- Let’s take a look at the formation of a company to illustrate how the accounting equation works in a business situation.

- For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

- For instance, if a business takes a loan from a bank, the borrowed money will be reflected in its balance sheet as both an increase in the company’s assets and an increase in its loan liability.

- This scenario illustrates the accounting equation perfectly, demonstrating how the components interact.

What Are the Key Components in the Accounting Equation?

Owner’s or stockholders’ equity also reports the amounts invested into the company by the owners plus the cumulative net income of the company that has not been withdrawn or distributed to the owners. $10,000 of cash (asset) will be received from the bank but the business must also record an equal amount representing the fact that the loan (liability) will eventually need to be repaid. Required Explain how each of the above transactions impact the accounting equation and illustrate the cumulative effect that they have. In the case of a limited liability company, capital would be referred to as ‘Equity’. This is how the accounting equation of Laura’s business looks like after incorporating the effects of all transactions at the end of month 1.

Assets

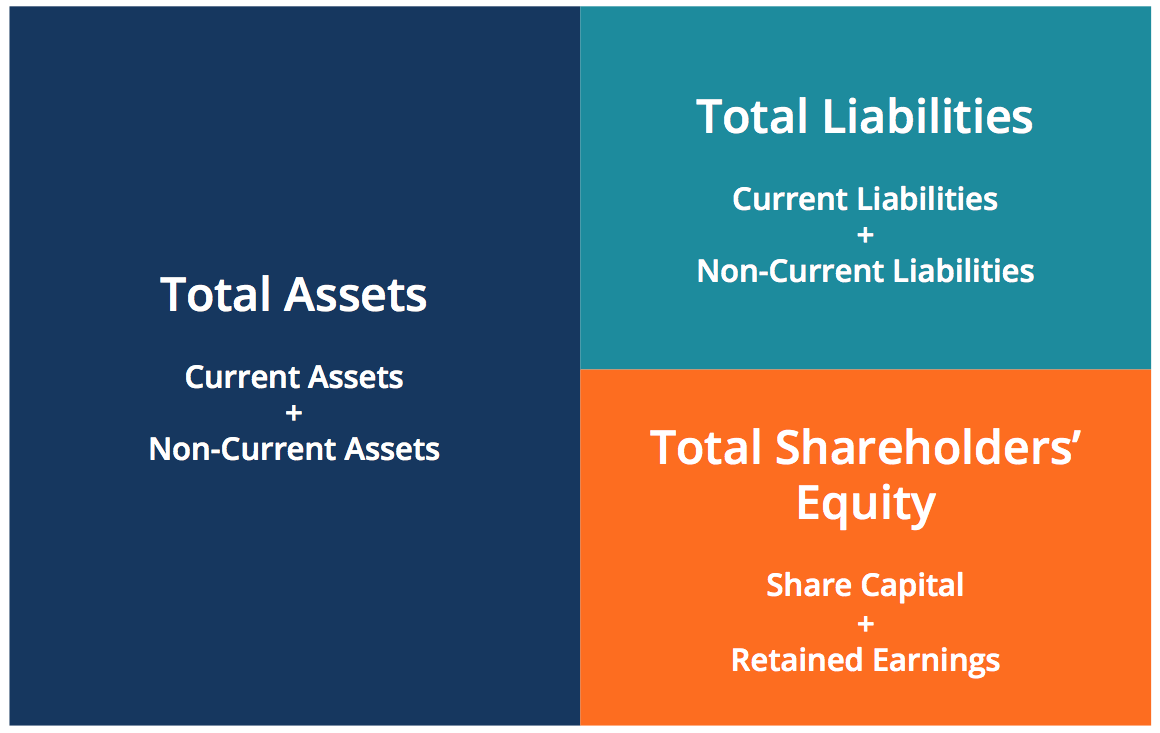

If assets increase, either liabilities or owner’s equity must increase to balance out the equation. The opposite is true if liabilities or equity increase. The accounting equation’s left side represents everything a business has (assets), and the right side shows what a business owes to creditors and owners (liabilities and equity). A company’s liabilities include every debt it has incurred. These may include loans, accounts payable, mortgages, deferred revenues, bond issues, warranties, and accrued expenses. The shareholders’ equity number is a company’s total assets minus its total liabilities.

Long-term liabilities are obligations that are due in more than one year, such as long-term loans and bonds payable. Understanding the difference between current and long-term liabilities helps in assessing a company’s short-term and long-term financial obligations. So now let’s discuss the cash flow frog, the foundation for everything you’re going to learn in this class. It’s already on your paper so I guess you’ve seen it already.

Owners can increase their ownership share by contributing money to the company or decrease equity by withdrawing company funds. Likewise, revenues increase equity while expenses decrease equity. The assets have been decreased by $696 but liabilities have decreased by $969 which must have caused the accounting equation to go out of balance. To calculate the accounting equation, we first need to work out the amounts of each asset, liability, and equity in Laura’s business. Like any brand new business, it has no assets, liabilities, or equity at the start, which means that its accounting equation will have zero on both sides. Essentially, the representation equates all uses of capital (assets) to all sources of capital, where debt capital leads to liabilities and equity capital leads to shareholders’ equity.

The accounting equation will always balance because the dual aspect of accounting for income and expenses will result in equal increases or decreases to assets or liabilities. The balance sheet is also known as the statement of financial position and it reflects the accounting equation. The balance sheet reports a company’s assets, liabilities, and owner’s (or stockholders’) equity at a specific point in time. Like the accounting equation, it shows that a company’s total amount of assets equals the total amount of liabilities plus owner’s (or stockholders’) equity.

The accounting equation is also called the basic accounting equation or the balance sheet equation. For every transaction, both sides of this equation must have an equal net effect. Below are some examples of transactions and how they affect the accounting equation. At this point, the balance of total assets is $50,000. The combined balance of liabilities and capital is also at $50,000.