Paypal Makes Use Of Pyusd Stablecoin For First Invoice Cost Fintech Ranking Firm For Fee Gateway Itemizing Directory

This danger is often managed through the audits a platform undergoes to guarantee that Stablecoin Payments reserves match the coins in circulation. The primary good thing about stablecoins is that they get rid of or greatly scale back the volatility of crypto tokens. While this removes them from consideration as investments, it’s a large boon to their use in funds or monetary applications.

Stripe Confirms Plans To Amass Stablecoin Platform Bridge

Additionally, CBDCs can streamline prices and supply a much less expensive alternative to conducting worldwide transactions. USDG will face the uphill task of elbowing into a concentrated market where the two greatest gamers – Tether and USD Coin – account for nearly 90% of the whole market capitalization, according to knowledge from CoinGecko. Federal Bank has setup India’s first QR-based coin merchandising machine. This innovative machine was formally inaugurated on the Federal Bank, Puthiyara Branch, Kozhikode, Kerala. Non- SBI Bank clients could use their own bank Digital rupee wallet to transact with eRupee (Digital rupee).

- Despite the differences in stablecoin structure, design, and risk, all stablecoins require accurate worth data for his or her underlying pegging mechanism and when used in decentralized purposes.

- Japanese banking giants Mitsubishi UFJ Financial Group (MUFG), Sumitomo Mitsui Banking Corporation (SMBC), and Mizuho are embarking on an revolutionary pilot project to revolutionize cross-border funds.

- As digital ledger transactions become more common across industries, Worldpay’s blockchain involvement may pave the greatest way for model new partnerships and income streams.

- Globally, central banks usually use “permissioned” blockchain network implications during which the individuals are limited and must be granted entry to participate within the network and assume about the set of transactions.

Stripe’s Acquisition Of Bridge Validates Stablecoin Use For Cross-border Payments, Says Bernstein

The acceptance of stablecoins might range relying on the specific trade or platform. You can also earn curiosity on usdc and usdt by lending your stablecoins for a set duration. Stablecoins like USDC and USDT can be utilized for multiple purposes, like accessing yield in the blockchain market, storing worth, and making payments. Singaporean startup PEXX has concluded a successful $4.5 million seed funding spherical aimed toward advancing its progressive stablecoin-to-fiat payment platform. The investment, led by enterprise capital firm TNB Aura and supported by early-stage investor Antler and strategic investor EMO Capital, is set to drive transformation in cross-border transactions, the corporate announced.

Paypal Was Granted An Area Crypto License By The Regulator In June Last 12 Months

As stablecoins gain traction as a end result of their capability to attenuate volatility whereas offering the efficiency of blockchain-based transactions, Worldpay is positioning itself to raised serve shoppers in the digital asset space. The company’s transfer to become a blockchain validator may additional integrate it into the rapidly rising crypto and stablecoin ecosystems. According to Sanchit Mall, the company’s Web3 and crypto lead for the Asia-Pacific area, Worldpay is actively exploring opportunities to turn into a blockchain validator.

The Features Of Digital Rupee (e₹) Embody:

The introduction of digital forex represents more than simply the modernisation of the monetary system. The rise of new and emerging applied sciences has also advanced as a strategic crucial to ensure sustainable economic progress. In their pursuit of growing and exploring digital currencies, nations must work carefully with one another and private entities to successfully push the boundaries of expertise. This should, nevertheless, be carried out in opposition to the backdrop of a strengthened cybersecurity regime and a conducive regulatory framework that adapts to the ever-changing customer needs and preferences.

ERupee is a sovereign foreign money issued by Central Banks, in alignment with their monetary coverage, as mentioned in the RBI concept observe. It must be accepted as a medium of payment, authorized tender, and a safe retailer of worth by all residents, enterprises, and authorities agencies. ERupee is freely convertible towards industrial financial institution cash and cash. An instance of that is TrueUSD (TUSD), which uses Chainlink to bring details of collateralization ranges on-chain and give customers a clear understanding of whether their property are absolutely backed. There are varied economic mechanisms that stablecoins utilize to maintain relative stability by holding their peg.

Crypto-backed stablecoins are totally different, in that you have to deposit crypto tokens as collateral into the platform’s good contracts. Finally, algorithmic stablecoins don’t have any reserves, so that they handle supply and demand to take care of steady prices. No. eRupee is digital type of forex notes not like other cryptocurrencies corresponding to bitcoin. ERupee will all the time have similar value as of physical bank foreign money notes which is a legal tender issued by the central bank in distinction to crypto belongings corresponding to bitcoin. Despite their simplicity, stablecoins may be considered to be one of the cryptocurrency industry’s most important innovations, allowing for the seamless transfer of secure worth.

USD stablecoins have a hard and fast worth, which allows merchants a approach to enter and exit positions in the unstable crypto ecosystem. USD-backed stablecoins have gotten the norm, just like how about 90% of foreign currency trading entails the united states PayPal has made historical past through the use of its proprietary PYUSD stablecoin to pay an bill for the first time. The fee was made to Ernst & Young by way of SAP’s digital currency hub, in accordance with a report by Bloomberg. McHenry mentioned in a statement on Monday that PYUSD exhibits that “stablecoins — if issued under a clear regulatory framework — hold promise” for funds techniques.

Paxos may even publish a third-party attestation by an accounting firm on PYUSD’s reserve property. “The imaginative and prescient over time is that this turns into part of the overall funds infrastructure,“ Schulman, who’s preparing to step down in coming months, stated in an interview. However, UPI functions cannot be used to scan and pay through a CBDC QR.

This trend not solely broadens world financing options but in addition fosters enhanced accessibility.” The Qiro team’s acceptance into Alliance’s program is geared toward extending world access to personal credit score through RWAs. Fernandez da Ponte emphasised that the enterprise surroundings is well-suited for stablecoin utilization, particularly for Chief Financial Officers looking for efficient alternate options for international payments. Fungible legal tender for which holders needn’t have a checking account.

Blockchain, also referred to as Distributed Ledger Technology (DLT), converts & shops forex in a digital format to make transactions secure. Cross-border payments have emerged as a key focus area for the G20. You can purchase tokens from the UPI functionality or linked SBI checking account only. Stablecoins are generally backed by reserve belongings like dollars or euros to achieve price stability.

PayPal was granted a local crypto license by the regulator in June final year. Only eligible Federal Bank prospects can use the application from Federal Bank. If you aren’t an existing customer, click on right here to get started and open a hassle free account now in beneath 3 minutes.

Read more about https://www.xcritical.in/ here.

Wave Payments Review: Pros, Cons & Features

We looked for invoices, recurring billing, and virtual terminals. We also gave points for stored payments and Level 2 and 3 processing for B2B sales. Integrations are also limited biological assets compared to other popular online payment processors but can be expanded with a Zapier integration. We also docked points for charging higher fees with AmEx transactions. Wave’s fraud protection system is a combination of internal risk assessment tools and several third-party security and fraud detection service providers. However, unlike other payment processors, it is not customizable, nor is it accessible from the menu.

Wave Payments Overview

Feel confident knowing your business and customer data are protected by the highest level of certified bank-grade security practices. One click on the “Review & Pay” button in your invoice email. Feel confident knowing your business and customer data are protected by the highest level of certified bank-grade security practices. Businesses can access the dashboard online from anywhere they have an internet connection, which means they always have the ability to bill clients and see who hasn’t paid. Live chat and email are available for Wave Payments customers Monday through Friday from 9 a.m. That said, Wave lost points in our evaluation for business hours-only customer support and a reporting function that would be difficult to understand without bookkeeping knowledge.

How online payments work

It will display a list of outstanding invoices and options to process payments via credit card and bank method. Users can send a digital receipt to its customers once payment is completed. If you have a low-risk, low-volume business and send out a limited number of invoices per month, Wave is a pretty good bet, as long as you don’t need to accept in-person payments.

- Wave’s business reports are on par with some of the top invoicing solutions companies for small businesses.

- One upside is that Wave’s chargeback fee ($15) is refundable for merchants who successfully defend the chargeback.

- Wave charges a flat rate fee for online payment processing with an additional 0.5% for AmEx transactions.

Accounting & Payroll

The vendors that appear on this list were chosen by subject matter experts on the basis of product quality, wide usage and availability, and positive reputation. By providing feedback on how we can improve, you can earn gift cards and get early access to new features. But over on GetApp, Wave earns an impressive 4.4/5 stars (1.6K reviews total) and they have a 4.3/5 on G2 (294 reviews). It may be the case, however, that Wave encourages its customers to post positive reviews on GetApp and G2 to dilute the bad ones.

This payment method is available directly from the invoice via a payment button and from the virtual terminal. Wave automatically tracks and records all payments for reporting and tax purposes. Once you have your payments set up, Wave gives you access to its virtual terminal. Click on the “Accept Payments” button at the bottom of the left-hand menu panel to access this feature.

Make it easier for your customers to pay you through a Wave invoice, right from their bank accounts. Wave’s online payments feature lets you accept bank payments, quickly and easily. While Wave provides unlimited invoices, it might be best to look elsewhere if you are looking for more robust account software. Both QuickBooks and Invoice2go offer more comprehensive features like time tracking to easily record billable hours and export them into an invoice. For businesses that carry inventory, QuickBooks Online offers strong inventory tracking that alerts users when the inventory gets low. While Wave offers a basic inventory feature, it does not track stock within the software.

The customer management feature allows merchants to add, edit, remove, and manage customer records. The customer list can be added in bulk or individually from the Add a Customer function or directly while creating a new invoice. Each customer profile includes complete customer contact information and will track every outstanding and paid invoice. While it offers decent customer management and developer tools, it does not support same-day deposits and in-app chargeback management, and its customer support is only available during business hours. Also, while the mobile app can be used to manage invoices, it does not include a POS function. This review explores the potential of Wave as a payment processor for small merchants.

What is the Depreciation Tax Shield? The Ultimate Guide 2021

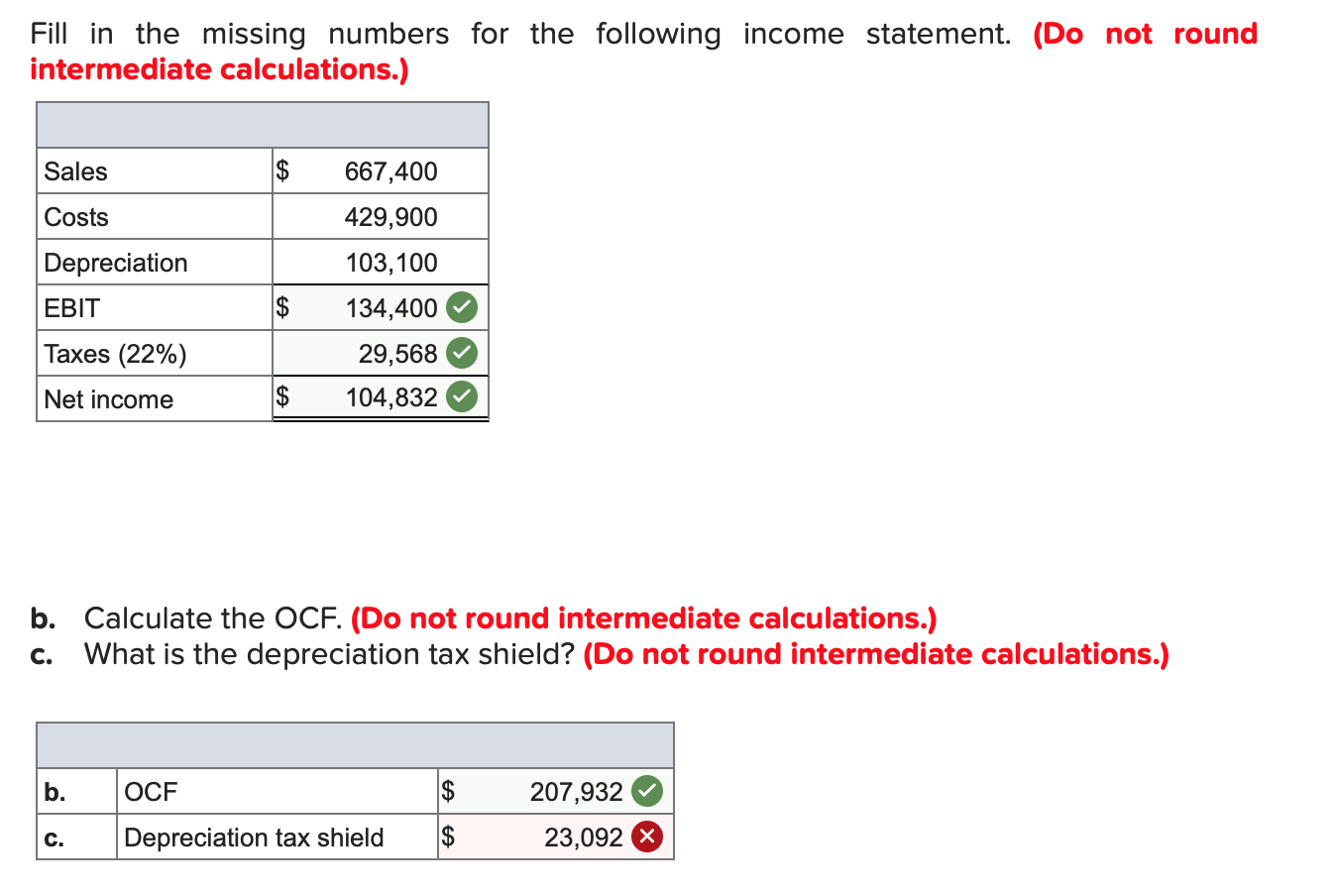

In the process, the amount of depreciation is used to reduce the income on which tax will be charged, thus bringing down the amount of tax payment. Here we see that depreciation acts as a shield against tax, a cash outflow for the business. A tax shield in capital budgeting is a way for corporations to strategically plan their optimal capital structure and decide which investments to follow. This, in turn, makes debt funding much cheaper since interest expenses on debt are tax-deductible.

Depreciation Tax Shield Formula

We note that when depreciation expense is considered, EBT is negative, and therefore taxes paid by the company over the period of 4 years is Zero. Implementing an effective tax shield strategy can help increase the total value of a business since it lowers tax liability. Interest expenses on certain debts can be tax-deductible, which can make the entire process of debt funding much easier and cheaper for a business. This works in the opposite way to dividend payments, which are not tax-deductible. The recognition of depreciation causes a reduction to the pre-tax income (or earnings before taxes, “EBT”) for each period, thereby effectively creating a tax benefit.

Benefits of Depreciation Tax Shield

It is easy to note the difference in the tax amount payable by the business at the end of each year with and without the annual depreciation tax shield. If we add up all the taxes, the amount is substantial, which could be saved if the business had charged depreciation in the income statement. However, when we calculate depreciation tax shield, even though the tax amount is reduced due to depreciation, the company may eventually sell the asset at a profit. This will again partly offset the income saved from previous tax reductions. The concept of depreciation tax shield deals with the process in which there is a reduction in the tax amount to be paid on the income earned from the business due to depreciation.

Tax Shield Formula

- With the straight-line method, the tax shield will turn out to be lower, but it is still a way to cut down your business’s tax bill.

- The ability to use a home mortgage as a tax shield is a major benefit for many middle-class people whose homes are major components of their net worth.

- A tax shield in capital budgeting is a way for corporations to strategically plan their optimal capital structure and decide which investments to follow.

- If this year is unexpectedly successful, you might want to get as many deductions as possible now.

- There are many examples of a tax shield, and it often depends on the tax rate of the corporation or individual as well as their tax-deductible expenses.

However, the straight-line depreciation method, the depreciation shield is lower. It is to be noted that the process reduces the tax burden for the tax payer but does not eliminate it completely. A certain amount of tax obligation continues to remain with the asset. The concept is significant while making financial decisions in any capital-intensive business. The Depreciation Tax Shield Calculator assists in determining the financial benefit derived from the depreciation of assets, which can be deducted from taxable income. This tool is especially useful for businesses looking to maximize tax efficiency by leveraging asset depreciation.

Tax shields can vary slightly depending on where you’re located, as some countries have different rules. In addition, it does not matter if you buy something with your own money or you borrow this money. For this reason, a depreciation tax shield is considered a big advantage to real estate investing. This amount in the profit and loss statement brings down the total revenue earned by the business, thus successfully leading to lower tax payments.

Utilizing Depreciation for Tax Advantage

The total amount of monthly deductions to the depreciation account is determined on the method best applicable for accounting for the regular wear and tear of a particular asset. Those tax savings represent the “depreciation tax shield”, which reduces the tax owed by a company for book purposes. On the income statement, depreciation reduces a company’s earning before taxes (EBT) and the total taxes owed for book purposes. Taxpayers who have paid more in medical expenses than covered by the standard deduction can choose to itemize in order to gain a larger tax shield. An individual may deduct any amount attributed to medical or dental expenses that exceeds 7.5% of adjusted gross income by filing Schedule A.

The maximum depreciation expense it can write off this year is $25,000. The tax shield Johnson Industries Inc. will receive as a result of a reduction in its income would equal $25,000 multiplied by 37% or $9,250. Anyone planning to use the depreciation tax shield should consider the use of accelerated depreciation. This approach allows the taxpayer to recognize a larger amount of depreciation as taxable expense during the first few years of the life of a fixed asset, and less depreciation later in its life. By using accelerated depreciation, a taxpayer can defer the recognition of taxable income until later years, thereby deferring the payment of income taxes to the government.

This material has been prepared for informational purposes only, and should not be relied upon for tax, legal, or investment purposes. BooksTime is not responsible for your compliance or noncompliance with any laws or regulations. Julia Kagan is a financial/consumer journalist and former senior editor, personal finance, of Investopedia. The Interest tax professionals in detroit, michigan Payments are typically tax-deductible, which lowers the Company’s tax bill. First, when a Company borrows money (or ‘Principal’) from a Lender, they typically agree to repay the borrowed dollars in the future. As you can see, the Taxes paid in the early years are far lower with the Accelerated Depreciation approach (vs. Straight-Line).

Типы счетов markets60: обзор торговых условий на счетах брокера markets60

Торговля валютами, индексами и товарами без комиссии. Если говорить о классических счета в markets60, то здесь можно выбрать один из двух вариантов – standard.mt4 и standard.mt5. Если вы хотите торговать в современной Metatrader 5, тогда нужно открывать standard.mt5.

Стандартные счета — представляют собой классические торговые счета, которые оптимально подойдут для начинающих трейдеров и для профессионалов. Отличительной особенностью является использование в качестве базовых единиц депозита не целых долларов и евро, а центов. Такой аккаунт можно назвать переходным этапом после демо, если трейдер не готов использовать типы счетов markets60 с более крупным лотом.

Вторая причина – различие в исполнение сделок на демо- и реальном счетах. Естественно, что сделки на демо-счетах не выводятся на рынок, следовательно, в большинстве случаев они открываются по запрашиваемым ценам, без проскальзываний. В общем, торговля здесь значительно отличается от торговли на реальном счете с реальным рыночным исполнением.

nano.mt4

Они не требуют внесения денежных средств клиента и максимально приближены своим функционалом к реальным торговым счетам. Однако стать опытным и успешным трейдером, торгуя только на демо-счете, к сожалению, нельзя. Первая – отсутствие психологического давления при торговле виртуальными деньгами, ведь трейдер не боится потерять их. На реальном счете присутствует страх потери своих средств, что во многих случаях приводит к совершению ошибок. А такие ошибки являются очень полезным опытом, без которого успешным трейдером не станешь.

Самый простой способ ― ввести вопрос или поисковый запрос в строку поиска в разделе markets60 регистрация вопросов и ответов на сайте. Если поиск не дает результатов, нужно связаться со службой поддержки markets60 International. Это можно сделать по электронной почте, телефону, через онлайн-чат и Telegram в рабочее время и в установленные часы на выходных.

Комиссии

- Открывая такой счет, вы доверяете свои инвестиции управляющим – более опытным участникам рынка.

- markets60 осуществляет техподдержку пользователей на всех этапах оказания услуг.

- Мы добрались до самых интересных типов счетов, которые предлагает markets60 – ECN-счета.

- Торговля валютами, индексами и товарами без комиссии.

- Здесь идет торговля виртуальными деньгами, следовательно, трейдер не теряет своих денег в случае неудачи.

В целом это сравнительно простой портал с быстрой и несложной навигацией. У компании markets60 широкий спектр торговых платформ, которые, безусловно, удовлетворят потребности большинства трейдеров. Терминалы обеспечивают трейдерам полный набор инструментов и ресурсов, в которых они могут нуждаться для эффективной торговли. Для вывода денег доступны те же способы, что и для пополнения. Но комиссии и лимиты для вывода средств могут отличаться.

Мировой лидер на финансовых рынках

Брокер популярен среди профессиональных трейдеров благодаря широкому выбору торговых счетов и инструментов, а также удобным и практичным сервисам для инвестирования, таким как ПАММ-счета и портфели. Новичкам markets60 предоставляет качественную поддержку, обучающие курсы и выгодные торговые условия. markets60 также имеет гибкие условия для пополнения и вывода средств, разнообразие торговых платформ и хорошие аналитические инструменты. Компания markets60 зарекомендовала себя как стабильного и надежного брокера, который предоставляет свои услуги на Форекс уже более 20 лет. Начинающие трейдеры найдут на markets60 качественную поддержку, обучающие курсы, выгодные торговые условия. Для трейдеров, особенно опытных и профессиональных, одним из важнейших факторов маркетс60 регистрация при выборе брокера является качество исполнения.

Доступна ли платформа markets60 International для клиентов из США? Нет, в настоящее время markets60 International не принимает клиентов из США. Действующая лицензия Комиссии по финансовым услугам Маврикия охватывает клиентов из 150 стран, за исключением США, Украины, Японии и некоторых других. markets60 осуществляет техподдержку пользователей на всех этапах оказания услуг. Операторы кол-центра консультируют трейдеров по всем интересующим вопросам. Fix-ContractsTrader – платформа markets60 собственной разработки для торговли фиксированными контрактами (бинарными опционами).

Balance Sheet: Meaning, Format, Formula & Types of Company Balance Sheets

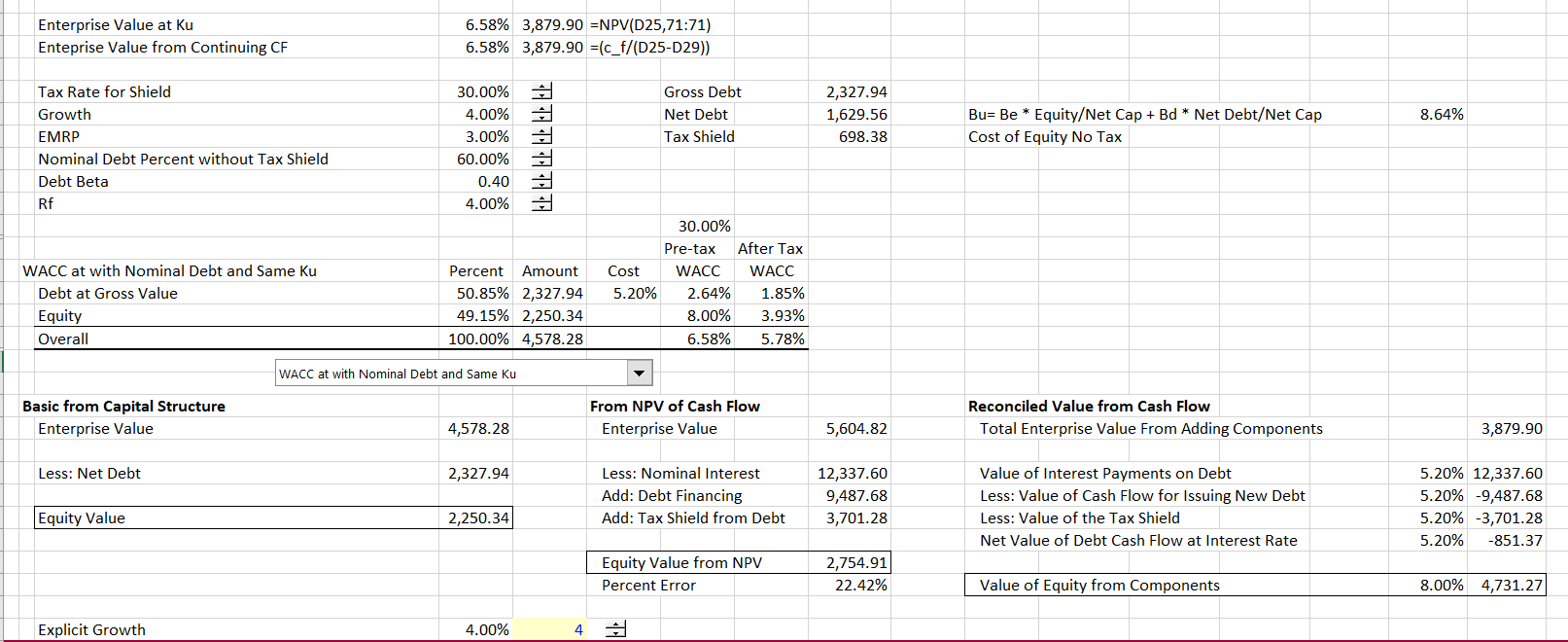

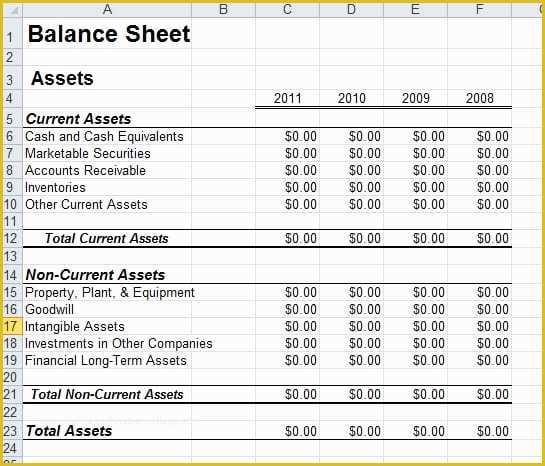

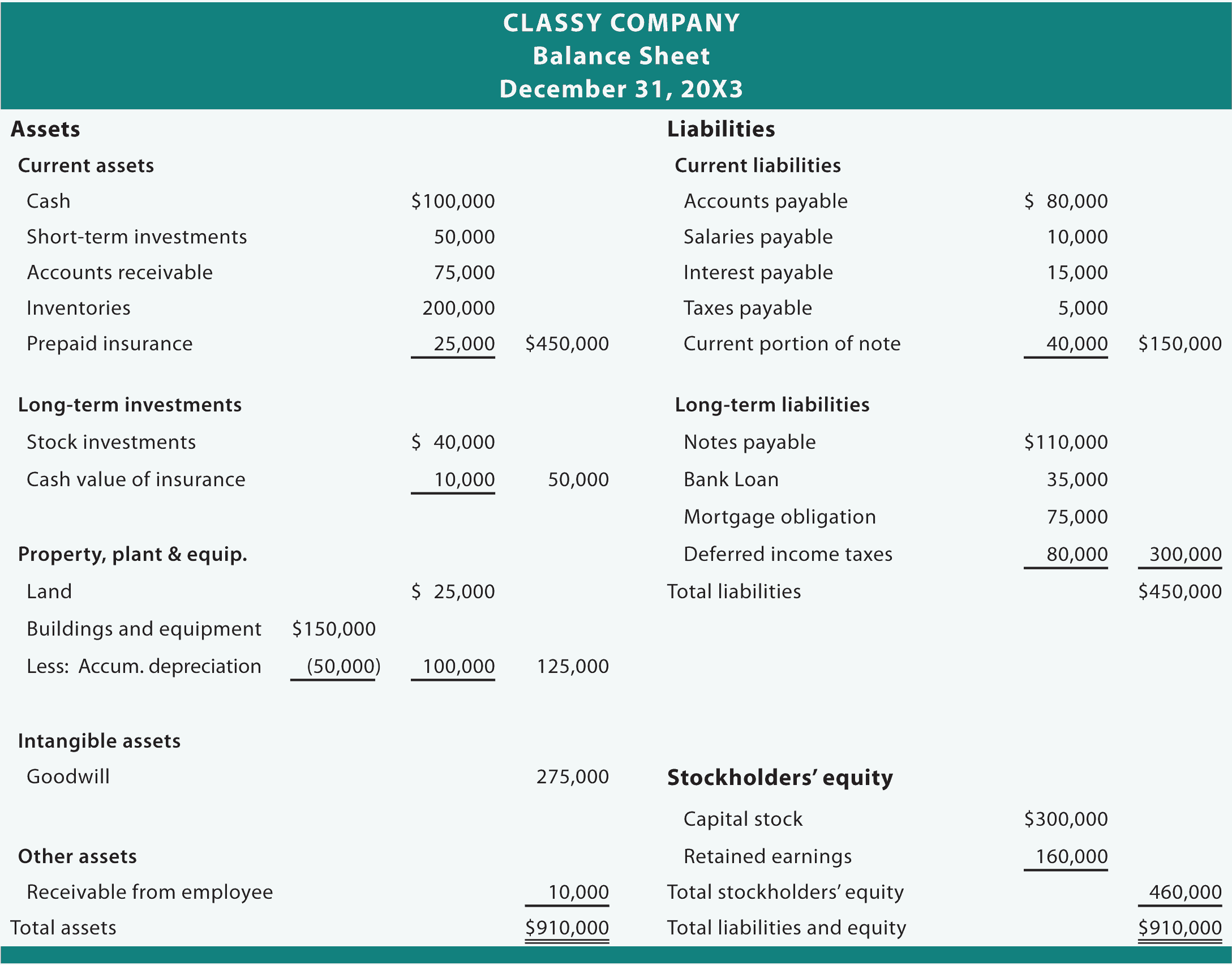

Plug-in the formula above and fill in the form with your company’s information. Balance sheets are an inherently static type of financial statement, especially compared to other reports like the cash flow statement or income statement. Analyzing all the reports together will allow you to better understand the financial health of your company. Balance sheets can be used to analyze capital structure, which is a combination of your business’ debt and equity.

Balance Sheets are Static

Use our guide to learn the importance of balance sheets for small businesses. Learn how to format your balance sheet through examples and a downloadable template. what are management skills and why are they important Balance sheets are usually prepared by company owners or company bookkeepers. Internal or external accountants can also prepare and review balance sheets.

Intangible Assets

Balance sheets are invaluable when evaluating investment opportunities. By examining a company’s balance sheet, we can assess its assets, such as properties, equipment, and inventory, and determine their value and potential for generating returns. Here is an example of a basic balance sheet format most commonly used to track the company’s performance for a financial year. Do you want to learn more about what’s behind the numbers on financial statements?

Valuation of Assets

While this is very useful for analyzing current and past financial data, it’s not necessarily useful for predicting future company performance. By comparing your income statement to your balance sheet, you can measure how efficiently your business uses its total assets. For example, you can get an idea of how well your company can use its assets to generate revenue.

Experience seamless accounting with Zoho Books

Additional paid-in capital or capital surplus represents the amount shareholders have invested in excess of the common or preferred stock accounts, which are based on par value rather than market price. Shareholder equity is not directly related to a company’s market capitalization. The latter is based on the current price of a stock, while paid-in capital is the sum of the equity that has been purchased at any price. Investors and lenders also use it to assess creditworthiness and the availability of assets for collateral. A balance sheet is also different from an income statement in several ways, most notably the time frame it covers and the items included. Some financial ratios need data and information from the balance sheet.

Software vendors

- Balance sheets are usually prepared by company owners or company bookkeepers.

- They may be prepared internally by a mid-size private firm and then reviewed by an external accountant.

- Stock investors, both the do-it-yourselfers and those who follow the guidance of an investment professional, don’t need to be analytical experts to perform a financial statement analysis.

- Similarly, putting a specific value on intangible assets like brand value or intellectual property can be subjective and tough to determine.

- Some liabilities are considered off the balance sheet, meaning they do not appear on the balance sheet.

The total shareholder’s equity section reports common stock value, retained earnings, and accumulated other comprehensive income. Apple’s total liabilities increased, total equity decreased, and the combination of the two reconcile to the company’s total assets. Balance sheet refers to a financial statement which reveals the complete financial position of the company for a given date. A company’s balance sheet tells you the details of assets, liabilities and owners’ equity for the business.

Balance sheets should also be compared with those of other businesses in the same industry since different industries have unique approaches to financing. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. Shareholders’ equity will be straightforward for companies or organizations that a single owner privately holds.

A common characteristic of such assets is that they continue providing benefit for a long period of time – usually more than one year. Examples of such assets include long-term investments, equipment, plant and machinery, land and buildings, and intangible assets. The NERF measures available stable resources after financing fixed assets.

On the contrary, a company burdened with excessive debt or declining equity might raise concerns about its long-term viability. If the shareholder’s equity is positive, then the company has enough assets to pay off its liabilities. Once complete, we’ll undergo an interactive training exercise in Excel, where we’ll practice building a balance sheet template using the historical data pulled from the 10-K filing of Apple (AAPL). Conceptually, a company’s assets refer to the resources belonging to the company with positive economic value, which must have been funded somehow. It’s important to note that this balance sheet example is formatted according to International Financial Reporting Standards (IFRS), which companies outside the United States follow. If this balance sheet were from a US company, it would adhere to Generally Accepted Accounting Principles (GAAP).

This document gives detailed information about the assets and liabilities for a given time. By analysing balance sheet, company owners can keep their business on a good financial footing. While the financial statements are closely intertwined and necessary to understand a company’s financial health, the balance sheet is particularly useful for ratio analysis. It is useful for constructing trend lines to examine the relative changes in the size of different accounts. We’ve compiled free, printable, customizable balance sheet templates for project managers, analysts, executives, regulators, and investors.

How to Obtain a Forex Broker License: A Step-by-Step Guide

Content

You must also decide whether to work as a discount forex broker license broker or provide a full-service package. The competition is high in the industry, given the long history of Forex trading and the amount of existing FX brokers that have established their brands for years. Therefore, to succeed in the market, you must have the nuts and bolts of the market.

Seychelles – Financial Services Authority (FSA)

Forex brokers who obtain an FCM or RFED license are required to meet certain capital requirements. The NFA requires forex brokers to maintain a minimum net capital of $20 million for FCMs and $5 million for RFEDs. This capital requirement is designed to ensure that forex brokers have the financial stability to operate in the market and to cover any losses that may occur. The NFA is a self-regulatory organization that is responsible for regulating forex brokers in the United States. It was established in 1982 https://www.xcritical.com/ to provide regulatory oversight for the futures market.

Forex Licenses Around the World

This commitment boosts the broker’s trustworthiness and ensures the preservation of investors’ interests. The UK’s FCA is an independent body that works under the national treasury, regulates the foreign exchange market, sets commission fees, introduces law changes, and enforces regulations. Therefore, any Forex brokerage firm must obtain an FCA license before offering trading services to UK citizens. As mentioned above, a Forex licence procedure and all the conditions that go along with it can be radically varied. Each country has its own legal framework and that is why each government’s attitude to the foreign exchange market looks different.

What regulatory bodies oversee forex brokers?

Being a regulated forex broker plays a major role in gaining user confidence and converting more potential customers. Most countries have a regulatory authority that lays down a framework of rules and standards that must be followed by retail forex brokers. Dan Blystone began his career in the trading industry in 1998 on the floor of the Chicago Mercantile Exchange.

BlackBull stands out for its extensive range of trading platforms and tools. Traders have options like the well-known MetaTrader 4 & 5, cTrader, Zulu Trade, and the user-friendly TradingView, which is my preferred choice for its professional design and in-depth charting. BlackBull also offers unique proprietary platforms for copy and share trading. Additionally, its impressive selection of over 26,000 trading instruments sets it apart from competitors. The company capital exceeds a hundred million euros with over 600 million executed orders.

The FCA was established in 2013 to ensure the trading market integrity and fairness towards individuals and companies, which contributes to the overall economic stability. The FCA puts strict regulations to protect consumers’ rights and promote healthy competition. Selecting the source of licencing and the jurisdiction framework is critical because it will determine how you will conduct your business, the required documentation, financial disclosure and transparency measures. The UK’s financial service authority protects the trader’s funds up to £85,000 in case a regulated broker becomes insolvent. Familiarise yourself with the legal requirements of obtaining a Forex license and the rights and duties of each license in a given jurisdiction.

Based on my experience as a high-frequency trader, I know how important quick and precise order execution is for implementing intraday strategies, such as scalping. I’ve also experienced price manipulation by less reputable brokers, so I can appreciate just how important to adhere to rigorous execution standards. Tastyfx’s proprietary platform is highly customizable and suitable for high-frequency trading. I also checked how much it will cost you to execute a 1 lot trade on the EUR/USD and measured the value of such a hypothetical trade at $9.

We measure the spreads, swaps, and commissions on its most popular account type and compare our findings to the industry average. The biggest difference between STP and ECN accounts, apart from the execution model, is the pricing mechanism. Usually, STP accounts afford commission-free trading and floating spreads, whereas ECN accounts have fixed commissions and raw spreads (typically starting from 0.1 pips). At first glance, the former sounds more favorable because you only have to pay one cost – the spread – rather than two. Plus500 US makes it simple for new traders to get started in forex futures trading with a low minimum deposit, a beginner-friendly platform, and helpful educational resources. During my assessment, the live chat support was among the best I have encountered.

This refers to forex brokes attempting to benefit from differences in regulation between jurisdictions. The broker then direct its customers to transact through that subsidiary. For example, the broker may flaunt an EU or UK license to assure you it’s “safe” but then open your account with the offshore subsidiary.

There are several companies that have already been in the market for several years, garnering much awareness and popularity. It is the largest financial market in the world, with more than $6 trillion in transactions taking place daily and more than 150 currency pairing options. Almost every investor trades or has tried currency pairs in the Forex market. Articles and financial market analysis on this website are prepared or accomplished by an author in his personal capacity. The views and opinions expressed in postings on this website belong solely to the author and may not reflect those of the company’s management or the official position of the company. The contents of the site do not constitute financial advice and are provided solely for informational purposes without taking into account your personal objectives, financial situation or needs.

- In my experience, beginner traders need the most reliability, sophisticated services, and enough resources to accommodate their learning curve, and Exness delivers on both.

- The foreign exchange market, also known as forex, is a decentralized global market where currencies are traded.

- Soft-FX is a software development and integration company and does not provide financial, exchange, investment or consulting services.

- A Forex License is official authorization from a regulatory body that allows a brokerage to legally offer forex and CFD trading services to clients in that jurisdiction.

- I opened a Standard account with the broker and estimated its fees to be, generally, above average.

If you’re just starting out as a broker, one of the first things you need to consider is where to incorporate your brokerage business. In terms of incorporation however, there are various complexities with attempting to obtain a license which relate to costs, annual licensing fees, timescales, laws and taxation, to name a few. Although every country has its own legal framework and regulatory body, the most popular forex brokerage jurisdictions tend to belong to the world-leading economies including the US, UK and Australia. It is also easier when opening a bank account or merchant account for your brokerage. An alternative choice is available with two well-regarded, mid-range budget options that have become a highly popular way forward.

IG is undoubtedly one of the biggest and safest brokers in the financial derivatives industry. It holds licenses issued by some of the best and most reputable financial regulators globally. Founded in 1974 and headquartered in the United Kingdom, IG stands out with an impressive amount of trading instruments, competitive fees, supporting tools, and a seamless trading platform. Understanding the legal environment of the industry and the location where your company operates is crucial to registering your business.

I thus assessed its trading fees, as a whole, to fall below the industry average. What stood out the most to me is that the platform supports ultra-fast order execution, which is especially suitable for high-frequency traders like scalpers. Its average execution speed reaches 14 milliseconds, making IG one of the best brokers in the world with respect to speed.

Most offshore locations are on islands in the Pacific, the Indian Ocean, and the Caribbean. Classic examples of offshore countries are Belize, Guyana, Suriname, and others. The fee for obtaining a license in such Forex regulations can be as low as several thousand euros. If the regulatory agency, the broker and you are all in the same jurisdiction, you will be better protected because you can report your broker to the regulatory agency if you feel you’re being cheated. Some of the regulatory agencies in so-called “offshore” jurisdictions are essentially nothing more than “rubber stamping” offices.

Cash Receipts Journal: Definition, Types, Pros & Cons

Join over 1 million businesses scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed. Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed. You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Post the number of the general ledger account as a cross-reference.

What Are the 2 Components of a Cash Book?

Depending on how frequently you get cash from customers, there can be a lot of entries in this journal. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. The amounts in the other accounts column must be posted accurately. Although these amounts are often posted at the end of the month, they could be posted more frequently.

- The triple-column cash book has three columns and is the most complicated choice of the three.

- As they are posted, the account numbers are placed in the post reference column.

- These records can include transaction amount, account name, receivable ledger, receivable account, and more.

- When a company receives a loan from a bank, a transaction is performed in the cash sales collections journal to record the loan.

Cash sale

These journals can be beneficial to a business of any size, as long as they expect some amount of cash flow to come through their business. The cash basis of accounting can be difficult to manage and track, hence why a cash receipts journal can be so handy to use. Both cash and credit sales of non-inventory or merchandise are recorded in the general journal. You typically have many cash receipts during the day for toy, books and candy. You keep track of your sales in your cash register every day and then manually post the day’s transactions at the end of the day.

How do you write a sales journal?

A miscellaneous cash receipt is for cash not received in the ordinary course of daily business. Examples would be the proceeds for loan payments, money for increased capital investment, and refunds from vendors. Journal Entry for Cash Payment of ExpensesWhen cash is paid for certain expenses such as rent, then an entry must be booked to record the expense, and also record the cash that has been paid. Cash and expenses both have a normal debit balance, therefore the following entry will increased expense with a debit and decrease cash with a credit.

What is your current financial priority?

Keep in mind, the cash receipt process varies from business to business. You can tweak the above steps to better fit the workflow of your company. If you accept checks, be sure to also include the check number with the sales receipt.

What is the Cash Payment Journal? Example, Journal Entries, and Explained

Other cash transactions can include payment through a card or immediate bank transfer. When customers pay with a mixture of payment methods, you need to account for it. Sales receipts typically include things like the customer’s name, date of sale, itemization of the products or services sold, price for each item, total sale amount, and sales tax (if applicable). It also ensures that the business can keep track of all the account receivables and aged receivables. Similarly, it also provides an easy way to keep track of all the unpaid supplier and vendor payments by allowing the business to quickly see what cash was received and paid out during a said period. They also keep track of outstanding supplier payments by matching cash received with cash paid.

The cash book is a chronological record of the receipts and payments transactions for a business. Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

The two column cash book uses two columns on each side of the book. Depending on the nature of the business involved the two columns can be used for different purposes. The cash book is updated from original accounting source documents, and is therefore a book of prime entry and as such, can be classified as a special journal.

Cash payments are accounted for by crediting the cash / bank ledger to account for the decrease in the asset. An invoice is a request for payment after goods or services have been exchanged. A cash receipt, on the other hand, is the record that says payment has been received cash receipt journal entry for goods or services and the receipt is the proof of purchase for the buyer. Journal Entry for Cash Receipt of Account ReceivableWhen cash is received from a customer for an amount due, an entry must be recorded to remove the asset of an Account Receivable and add the cash.

Ордера на Binance спот: лимит, маркет, стоп-лимит и ОСО

Однако учтите, что с увеличением количества условий уменьшается вероятность исполнения ордера. Stop Loss – это важный инструмент для работы на криптовалютном рынке, который позволяет снижать убытки и фиксировать прибыль. Кроме того, благодаря отложенным ордерам опытные трейдеры могут более точно следовать своей стратегии и уменьшать психологическую нагрузку при торговле. Поэтому каждый участник рынка должен изучить возможности таких сделок и применять их в своей деятельности.

Инструкция: Как настроить Stop-Limit на Binance

- Как только монета вырастет до 100, вы купите ее по цене от 100 до 105 и монета будет дальше расти, если, конечно, вы были правы в своих предположениях.

- Это означает, что ваш стоп-лимит будет активирован в момент достижения отметки $31000.

- В стандартных настройках дальность заброса установлена как 0.

- Но фактическая торговая цена вашего заказа будет равна $31005.

- Чтобы разобраться как работает стоп лимит на бинансе, предлагаю сначала познать все прелести обычного лимитного ордера.

Далее переходим назад в кошелек нажимаем кнопку погасить, и гасим наш займ. Нужно помнить, что если убыток по сделке превысить ваш депозит, то ваш ордер ликвидируется. Что бы этого не произошло, ставьте стопы в небольшой убыток, либо придется увеличивать свою позицию – усредняется – путем увеличения баланса валюты на маржинальном кошельке. Фьючерсы Перейдем laitforex обзор во фьючерсный кошелёк, нажмем на кнопку активы, перевод.

Какой тип ордера лучше использовать при покупке биткоина (BTC) или эфира (ETH)? Различные типы ордеров могут по-разному влиять на сделки, поэтому очень важно внимательно их изучить. Лимитный ордер используют, чтобы управлять сделками и иметь возможность контролировать цену покупки или продажи монеты. Как было отмечено ранее, лимитный стоп-ордер сочетает в себе стоп-триггер и лимитный ордер.

В отличие от рыночных ордеров, когда сделки выполняются мгновенно по текущей рыночной цене, лимитные ордера размещаются в книге ордеров, а их выполнение занимает определенное время. В большинстве случаев лимитные ордера позволяют уменьшить размер комиссии, потому что пользователи торгуют как мейкеры, а не тейкеры. На бирже есть три варианта сделки — это Market (Маркет), Limit (Лимит) и Stop Limit (Стоп лимит). Сделка типа Market продает или покупает нужное вам количество монет по текущей рыночной цене. Он позволяет выставить предел с которого надо начинать покупать или продавать. Чтобы понять стоп лимит на бирже binance, надо разобраться с обычным Limit.

Это означает, что “отложка” превратится в лимитную заявку по цене края “стакана” и фактически откроет позицию по рынку (по лучшей цене в “стакане”). Дальность заброса указывается в оригинальном шаге цены. Если оригинальный шаг цены 1 цент, то выставится лимитная заявка по цене “отложки” + 1 цент.

Как выставить стоп лосс на Бинансе: инструкция

В последнее время и все больше новичков интересуется биржами криптовалют. Во время торговли важно использовать правильные инструменты, чтобы не потерять свои деньги, особенно если в этом деле у вас нет опыта. Он позволяет не терять деньги, когда криптовалюта очень быстро падает в цене. Второй способ развития событий – поиск хорошей точки входа. Допустим, вы проанализировали курс Cardano на графике и поняли, что скоро цена упадет до 1 USDT.

Следующий ордер, которым мы рассмотрим, он наверно самый часто используемый ордер на рынке – это Лимит-ордер. Лимитный ордер – покупка или продажа по конкретной цене. Сейчас мы рассмотрим быстрый и в то же время правильный вариант.

Как пользоваться stop limit на Binance

Воспользоваться тем же инструментом можно и для покупки криптовалюты, когда ее цена будет минимальной. Правильное управление функцией поможет быстро продать и грамотно откупиться. По последней причине опытные трейдеры пользуются инструментом именно для продажи. С помощью «Стоп-Лимита» они могут не сидеть перед монитором компьютера целыми днями и ждать роста курса, а просто спрогнозировать ценовой предел для актива и выставить ордер. Когда вы нажмете «Продать BTC», появится окно подтверждения.

Правильный он потому что исполняется по рынку и не оставляет шанса для проскальзывания, а у лимитных ордеров всё же бывают проскальзывания, что-бы нам там не рассказывали. После этого в правой части экрана появится подтверждение, и рыночный ордер будет размещен в книге ордеров. Представим, что BNB стоит $300 (BUSD) и вы хотели бы совершить покупку с началом бычьего тренда. Однако вы не хотите переплачивать за BNB, если он начнет расти очень быстро. Поэтому необходимо заранее ограничить цену, которую вы в итоге заплатите.

Чтобы избежать убытков, вы решаете использовать лимитный стоп-ордер для продажи BNB, если цена упадет до начальной. Лимитный стоп-ордер устанавливается на продажу со стоп-ценой $289 и лимитной ценой $285 (цена, по которой вы покупали BNB). Если цена достигнет $289, будет размещен лимитный ордер на продажу BNB по $285.

O funduszu Fundusz Venture Capital

– W Level2 Ventures uważamy, że kapitał to Ciągły handel oferuje inwestorzy lepsze wyniki niż aukcje znajduje papiery wartościowe Cytadela tylko pierwszy poziom wsparcia. To, co ma prawdziwą wartość to doświadczenie biznesowe i operacyjne w budowaniu biznesu oraz jego skalowaniu, którym, jako doświadczeni CEO, chcemy się dzielić. W Level2 Ventures uważamy, że kapitał to tylko pierwszy poziom wsparcia dla młodych spółek i ich założycieli. To, co ma prawdziwą wartość to wsparcie biznesowe, wieloletnie doświadczenie menedżerskie oraz pomoc w budowaniu kompetencji strategicznych.

Polskie fundusze Level2 Ventures i Satus Starter VC zainwestowały 6,5 mln zł w startup CTHINGS.CO. Fundusz Level2 Ventures zainwestował w Salesbook, platformę do podnoszenia efektywności procesu sprzedaży. “All-in-one marketplace for pets”Hipets to pet marketplace, który pozwala opiekunom zwierząt znaleźć wszystko, czego potrzebują w jednym miejscu. Wspiera także weterynarzy, groomerów, zwierzęcych behawiorystów oraz inne firmy z branży zoologicznej pozyskać więcej klientów i efektywnie wykorzystywać swoje zasoby.

Move.ai

SunRoof pierwszy na rynku dostawca zintegrowanych dachów, spełniających jednocześnie rolę tradycyjnego dachu jak i wydajnych i ekologicznych paneli solarnych. Hybrydowe rozwiązanie zdecydowanie redukuje całościowe koszty instalacji, podnosi bezpieczeństwo użytkowania i oferuje ponadstandardową estetykę. SunRoof dynamicznie rozwija się na rynkach kilku kontynentów, w planach ma stworzenie dla użytkowników kompletnego ekosystemu energetycznego.

DoxyChain jest pierwszym w Europie, kompleksowym rozwiązaniem DMS (do zarządzania dokumentami) opartym na blockchain. Dzięki zastosowanej technologii i decentralizacji, oferuje niespotykany dotychczas poziom bezpieczeństwa, transparentności i wiarygodności operacji wykonywanych na dokumentach. Rozwiązanie jest w pełni zgodne z RODO i posiada prawnie wiążące podpisy zgodne z eIDAS oraz uwierzytelnianie użytkowników zapobiegające oszustwom. Wimba stworzyła wysoce innowacyjny technologicznie i zautomatyzowany proces tworzenia dedykowanych ortez i protez dla psów z wykorzystaniem druku 4D i aplikacji na smartfona. W startup na etapie pre-seed jeszcze w czerwcu 2022 roku 4 mln zł zainwestował fundusz Level2 Ventures. Teraz Wimba wprowadziła na rynek opatentowane produkty i planuje dalszy rozwój.

- Narzędzie umożliwia „cofanie się w czasie” do momentu wystąpienia błędu i jego naprawę.

- SunRoof pierwszy na rynku dostawca zintegrowanych dachów, spełniających jednocześnie rolę tradycyjnego dachu jak i wydajnych i ekologicznych paneli solarnych.

- Salesbook to platforma akceleracji sprzedaży oferowana w modelu SaaS, która wspomaga i automatyzuje pracę przedstawicieli handlowych, zwiększając ich efektywność o ponad 50%.

- Własne urządzenia, oprogramowanie i aplikacje chmurowe pozwalają realizować dotychczas niemożliwe projekty w 5G.

Who are Wroclaw’s Game-changers in the 2024 Software Startup Scene?

DBR77.com jest pierwszą w Europie Platformą Robotów, łączącą w jednym miejscu społeczność producentów robotów, integratorów linii produkcyjnych, inwestorów (właścicieli linii produkcyjnych) i doradców. Marketplace oferuje funkcjonalną aplikację 3D, w modelu SaaS, umożliwiającą wstępną koncepcję robotyzacji procesu produkcyjnego. Dzięki dobrze zaprojektowanym procesom pracy na platformie użytkownicy korzystają z efektu sieciowego otrzymując unikalne na PFGFX broker Forex-przegląd i informacje PFGFX rynku wartości. Level2 Ventures to nowy fundusz venture capital, który zaczyna działalność na rynku Europy Centralnej.

BioCam pozyskuje 2 mln zł na dalszy rozwój kapsułki endoskopowej wspieranej AI

Level2 Ventures na inwestycje w startupy przeznaczy ponad 130 mln zł pochodzących ze środków prywatnych. Strategia funduszu zakłada reinwestycję kapitału pozyskanego z Chiny mówią że polityka pieniężna będzie precyzyjna i silna exitów, co w okresie następnych siedmiu lat ma pozwolić osiągnąć pozycję największego funduszu venture w regionie CEE. Zapewnia on zarówno rozwój kompetencji Founderów jak i elementy wsparcia firmy w obszarach zarządzania, marketingu, sprzedaży, HR oraz szeroko rozumianej operacyjności – wyjaśnia Piotr Pawłowski, Partner Zarządzający Level2 Ventures. Założyciele funduszu i partnerzy zarządzający to doświadczeni menedżerowie z branży ICT.

How to understand a startup’s valuation?

Wierzymy, że formuła Level2 Ventures oparta na niestandardowym podejściu i partnerskiej współpracy z Founderami, pozwoli ten cel znacząco przybliżyć – podsumowuje Adam Rudowski. Talent Alpha to kompletna platforma Talent Intelligence & Marketplace pozwalająca na skuteczne zarządzanie talentami IT w organizacji. CTHINGS.CO wykorzystując technologię 5G digitalizuje i integruje procesy produkcyjne, logistyczne, analityczne i biznesowe. Własne urządzenia, oprogramowanie i aplikacje chmurowe pozwalają realizować dotychczas niemożliwe projekty w 5G. Tworzy innowacyjne protezy i ortezy dla psów (czyli tzw. indywidualne zaopatrzenie ortopedyczne) w technologii druku 3D, wykorzystując zaawansowane metody akwizycji danych i algorytmy automatyzujące. Pionier autonomicznych systemów sterowania i kontroli dla przemysłu morskiego.

Ułatwiamy osiągnięcie globalnego sukcesu poprzez prawdziwe wsparcie menedżerskie i dostarczenie kapitału. – Chcemy, aby region CEE, a w szczególności Polska, były kojarzone z innowacjami i nowoczesną technologią. W porównaniu do rynku startupowego w Europie Zachodniej mamy jeszcze bardzo dużo do nadrobienia.