Matching Principle in Accounting: Importance, Examples, and Challenges

The matching principle is an essential concept in accounting that requires a company to report expenses in the same period as their corresponding revenue. This principle helps to ensure a company’s financial statements are accurate and portray an accurate picture of the business’s performance. By implementing accrual basis accounting, you can ensure that expenses are recognized when they are incurred, even if cash is not yet received. This approach provides a more accurate reflection of the financial performance of your business. The matching principle links expenses to the related revenues, while the revenue recognition principle requires revenue to be recognized when it’s earned. They ensure accurate financial reporting by recognizing revenue in the period it’s earned and linking expenses to the revenues it generates.

What is the matching principle in accounting?

Matching principle states that business should match related revenues and expenses in the same period. They do this in order to link the costs of an asset or revenue to its benefits. Matching principle is an accounting principle for recording revenues and expenses.

Ready to Put Your Record to Report on Auto-Pilot?

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Similarly, if a fee is earned for providing a service, the first test is to ensure that the service in question has been duly provided. If we include any revenue in a particular period, we should be sure of two key facts.

- Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

- The expense will continue regardless of whether revenues are generated or not.

- At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

- PP&E, unlike current assets such as inventory, has a useful life assumption greater than one year.

What is the Matching Principle in Accounting

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

What are the different types of expenses under the matching principle?

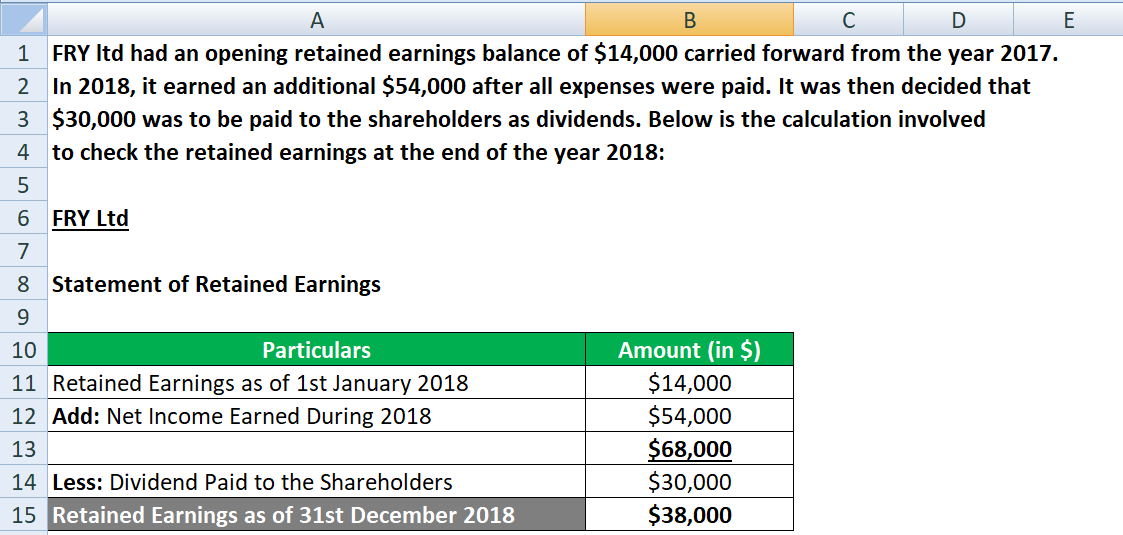

The matching concept, also known as the matching principle or accrual accounting principle, is a fundamental concept in accounting that guides the recognition of revenues and expenses. It states that expenses should be recognized in the same accounting period as the revenues they help to generate, regardless of when the cash transactions occur. In other words, the matching concept ensures that expenses are matched with the revenues they help to generate in order to accurately reflect the profitability of a business for a given period. Similarly, cash paid for goods and services not received by the end of the accounting period is added to prepayments. This practice prevents the expense from being recorded as a fictitious loss in the payment period and as a fictitious profit in the period when the goods or services are received.

A Comprehensive Guide to Cost Allocation [With Methods & Examples]

The matching principle (also known as the expense recognition principle) is one of the ten Generally Accepted Accounting Principles (GAAP). For example, If the fixed assets amount to $50,000 and depreciation for five years as the result of economic use. Then, the depreciation expenses amount to $10,000 per year should be recorded.

If an expense is not directly tied to revenues, the expense should be reported on the income statement in the accounting period in which it expires or is used up. If the future benefit of a cost cannot be determined, it should be charged to expense immediately. If you violate the matching principle when producing financial statements, the accuracy and reliability of those statements will be compromised.

It aligns with the matching principle by ensuring that expenses are matched with the corresponding revenues. Understanding the matching principle is crucial for accounting functions as it enables businesses to accurately report their financial performance. By matching expenses with the corresponding revenues, businesses can provide stakeholders with meaningful when will i get my tax rebate if i used turbo tax online to file my tax return and reliable financial information. This information is essential for decision-making, assessing profitability, and evaluating the overall financial health of a company. The revenue recognition principle is another accounting principle related to the matching principle. It requires reporting revenue and recording it during realization and earning.

The coupon to be paid by the bond issuer gets accumulated from the date of issue until paid. Hence, in the issuer’s book of account, some amount pertains to the coupon to be paid to investors monthly. It is called the accrued interest for the investor (and has relative terms concerning other regular return-paying investments).