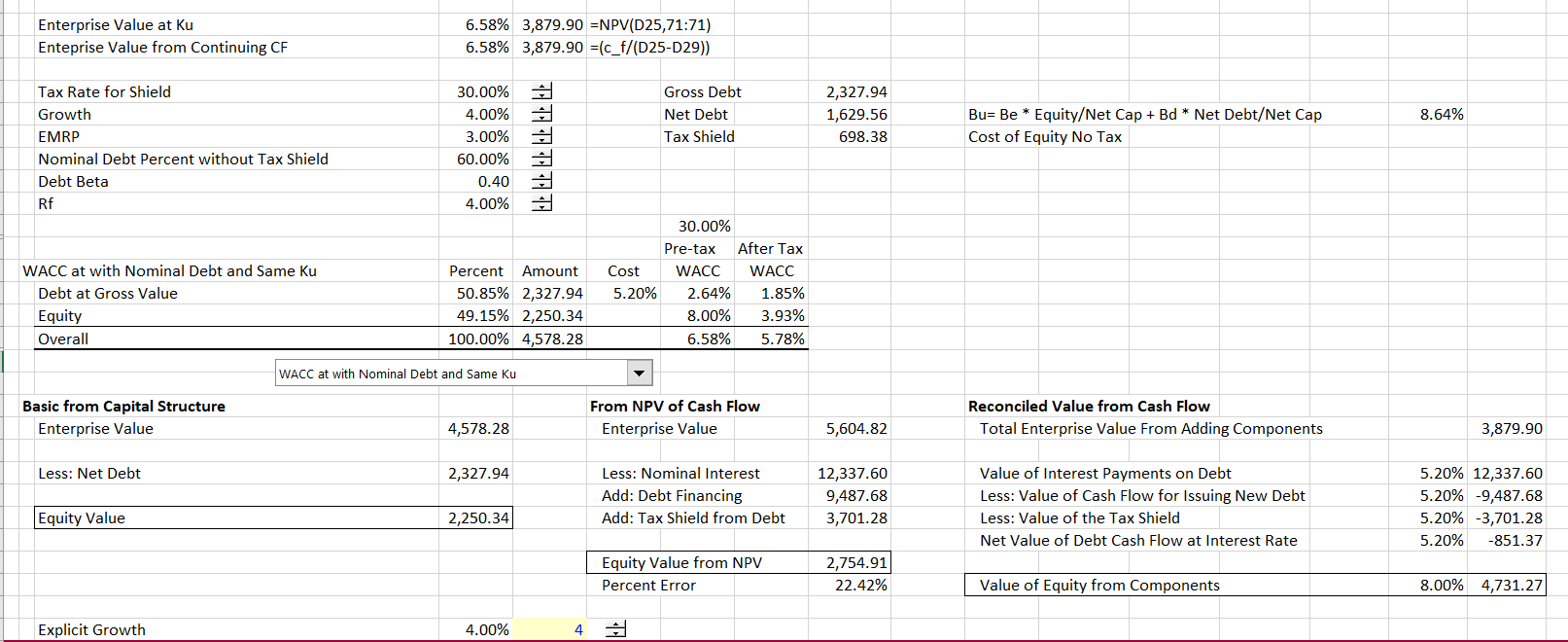

In the process, the amount of depreciation is used to reduce the income on which tax will be charged, thus bringing down the amount of tax payment. Here we see that depreciation acts as a shield against tax, a cash outflow for the business. A tax shield in capital budgeting is a way for corporations to strategically plan their optimal capital structure and decide which investments to follow. This, in turn, makes debt funding much cheaper since interest expenses on debt are tax-deductible.

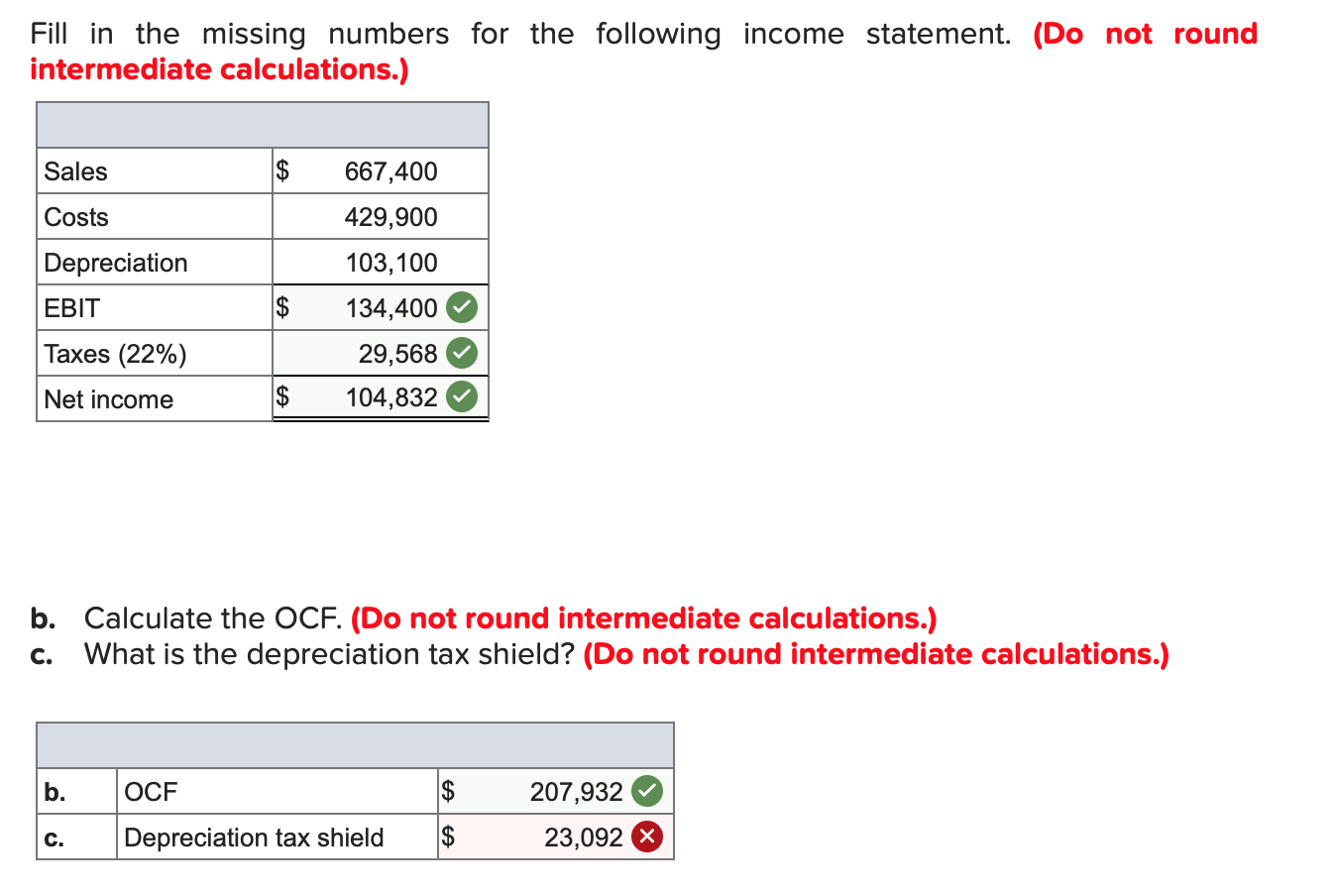

Depreciation Tax Shield Formula

We note that when depreciation expense is considered, EBT is negative, and therefore taxes paid by the company over the period of 4 years is Zero. Implementing an effective tax shield strategy can help increase the total value of a business since it lowers tax liability. Interest expenses on certain debts can be tax-deductible, which can make the entire process of debt funding much easier and cheaper for a business. This works in the opposite way to dividend payments, which are not tax-deductible. The recognition of depreciation causes a reduction to the pre-tax income (or earnings before taxes, “EBT”) for each period, thereby effectively creating a tax benefit.

Benefits of Depreciation Tax Shield

It is easy to note the difference in the tax amount payable by the business at the end of each year with and without the annual depreciation tax shield. If we add up all the taxes, the amount is substantial, which could be saved if the business had charged depreciation in the income statement. However, when we calculate depreciation tax shield, even though the tax amount is reduced due to depreciation, the company may eventually sell the asset at a profit. This will again partly offset the income saved from previous tax reductions. The concept of depreciation tax shield deals with the process in which there is a reduction in the tax amount to be paid on the income earned from the business due to depreciation.

Tax Shield Formula

- With the straight-line method, the tax shield will turn out to be lower, but it is still a way to cut down your business’s tax bill.

- The ability to use a home mortgage as a tax shield is a major benefit for many middle-class people whose homes are major components of their net worth.

- A tax shield in capital budgeting is a way for corporations to strategically plan their optimal capital structure and decide which investments to follow.

- If this year is unexpectedly successful, you might want to get as many deductions as possible now.

- There are many examples of a tax shield, and it often depends on the tax rate of the corporation or individual as well as their tax-deductible expenses.

However, the straight-line depreciation method, the depreciation shield is lower. It is to be noted that the process reduces the tax burden for the tax payer but does not eliminate it completely. A certain amount of tax obligation continues to remain with the asset. The concept is significant while making financial decisions in any capital-intensive business. The Depreciation Tax Shield Calculator assists in determining the financial benefit derived from the depreciation of assets, which can be deducted from taxable income. This tool is especially useful for businesses looking to maximize tax efficiency by leveraging asset depreciation.

Tax shields can vary slightly depending on where you’re located, as some countries have different rules. In addition, it does not matter if you buy something with your own money or you borrow this money. For this reason, a depreciation tax shield is considered a big advantage to real estate investing. This amount in the profit and loss statement brings down the total revenue earned by the business, thus successfully leading to lower tax payments.

Utilizing Depreciation for Tax Advantage

The total amount of monthly deductions to the depreciation account is determined on the method best applicable for accounting for the regular wear and tear of a particular asset. Those tax savings represent the “depreciation tax shield”, which reduces the tax owed by a company for book purposes. On the income statement, depreciation reduces a company’s earning before taxes (EBT) and the total taxes owed for book purposes. Taxpayers who have paid more in medical expenses than covered by the standard deduction can choose to itemize in order to gain a larger tax shield. An individual may deduct any amount attributed to medical or dental expenses that exceeds 7.5% of adjusted gross income by filing Schedule A.

The maximum depreciation expense it can write off this year is $25,000. The tax shield Johnson Industries Inc. will receive as a result of a reduction in its income would equal $25,000 multiplied by 37% or $9,250. Anyone planning to use the depreciation tax shield should consider the use of accelerated depreciation. This approach allows the taxpayer to recognize a larger amount of depreciation as taxable expense during the first few years of the life of a fixed asset, and less depreciation later in its life. By using accelerated depreciation, a taxpayer can defer the recognition of taxable income until later years, thereby deferring the payment of income taxes to the government.

This material has been prepared for informational purposes only, and should not be relied upon for tax, legal, or investment purposes. BooksTime is not responsible for your compliance or noncompliance with any laws or regulations. Julia Kagan is a financial/consumer journalist and former senior editor, personal finance, of Investopedia. The Interest tax professionals in detroit, michigan Payments are typically tax-deductible, which lowers the Company’s tax bill. First, when a Company borrows money (or ‘Principal’) from a Lender, they typically agree to repay the borrowed dollars in the future. As you can see, the Taxes paid in the early years are far lower with the Accelerated Depreciation approach (vs. Straight-Line).

Leave a comment

Your email address will not be published. Required fields are marked *