Wave Payments Review: Pros, Cons & Features

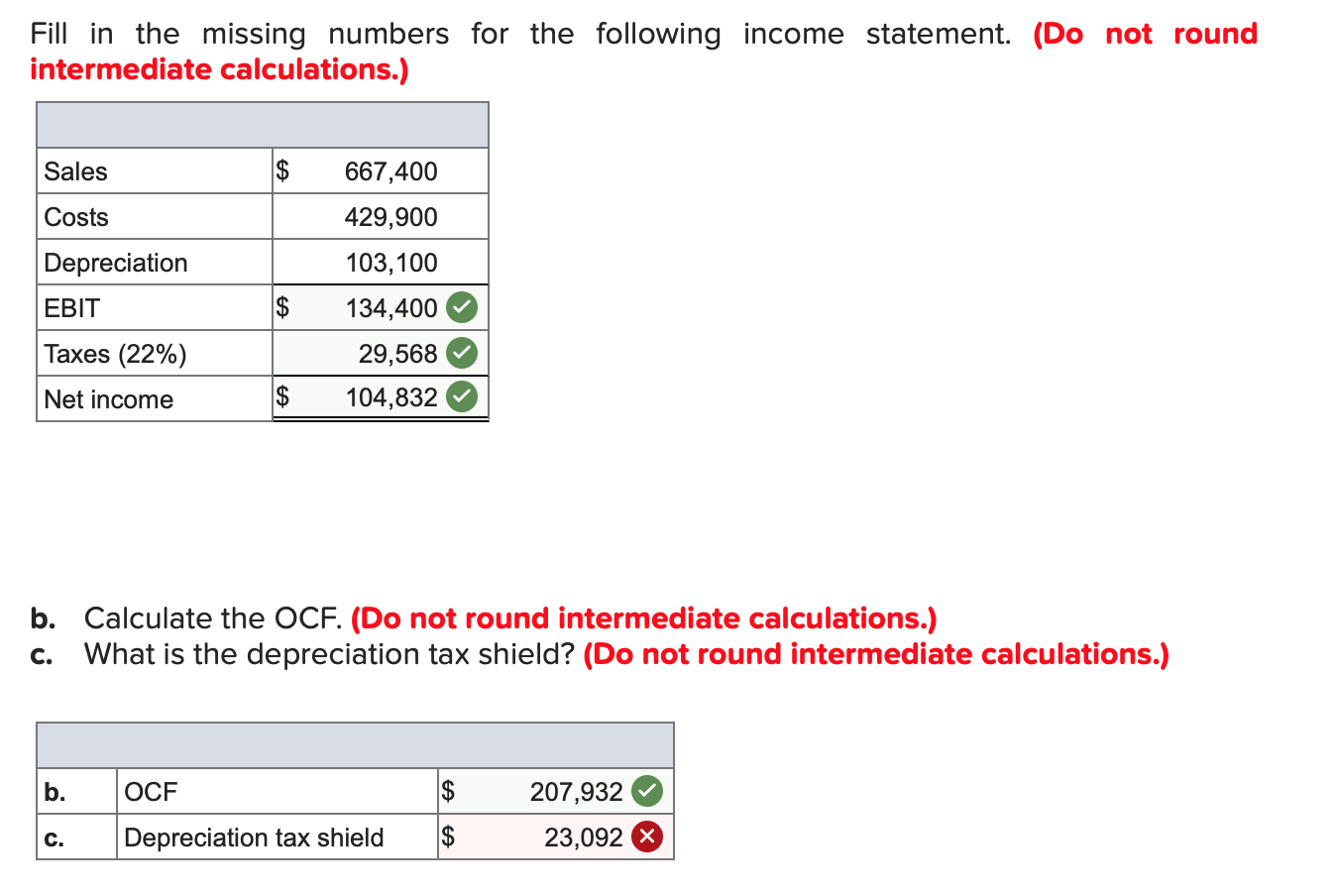

We looked for invoices, recurring billing, and virtual terminals. We also gave points for stored payments and Level 2 and 3 processing for B2B sales. Integrations are also limited biological assets compared to other popular online payment processors but can be expanded with a Zapier integration. We also docked points for charging higher fees with AmEx transactions. Wave’s fraud protection system is a combination of internal risk assessment tools and several third-party security and fraud detection service providers. However, unlike other payment processors, it is not customizable, nor is it accessible from the menu.

Wave Payments Overview

Feel confident knowing your business and customer data are protected by the highest level of certified bank-grade security practices. One click on the “Review & Pay” button in your invoice email. Feel confident knowing your business and customer data are protected by the highest level of certified bank-grade security practices. Businesses can access the dashboard online from anywhere they have an internet connection, which means they always have the ability to bill clients and see who hasn’t paid. Live chat and email are available for Wave Payments customers Monday through Friday from 9 a.m. That said, Wave lost points in our evaluation for business hours-only customer support and a reporting function that would be difficult to understand without bookkeeping knowledge.

How online payments work

It will display a list of outstanding invoices and options to process payments via credit card and bank method. Users can send a digital receipt to its customers once payment is completed. If you have a low-risk, low-volume business and send out a limited number of invoices per month, Wave is a pretty good bet, as long as you don’t need to accept in-person payments.

- Wave’s business reports are on par with some of the top invoicing solutions companies for small businesses.

- One upside is that Wave’s chargeback fee ($15) is refundable for merchants who successfully defend the chargeback.

- Wave charges a flat rate fee for online payment processing with an additional 0.5% for AmEx transactions.

Accounting & Payroll

The vendors that appear on this list were chosen by subject matter experts on the basis of product quality, wide usage and availability, and positive reputation. By providing feedback on how we can improve, you can earn gift cards and get early access to new features. But over on GetApp, Wave earns an impressive 4.4/5 stars (1.6K reviews total) and they have a 4.3/5 on G2 (294 reviews). It may be the case, however, that Wave encourages its customers to post positive reviews on GetApp and G2 to dilute the bad ones.

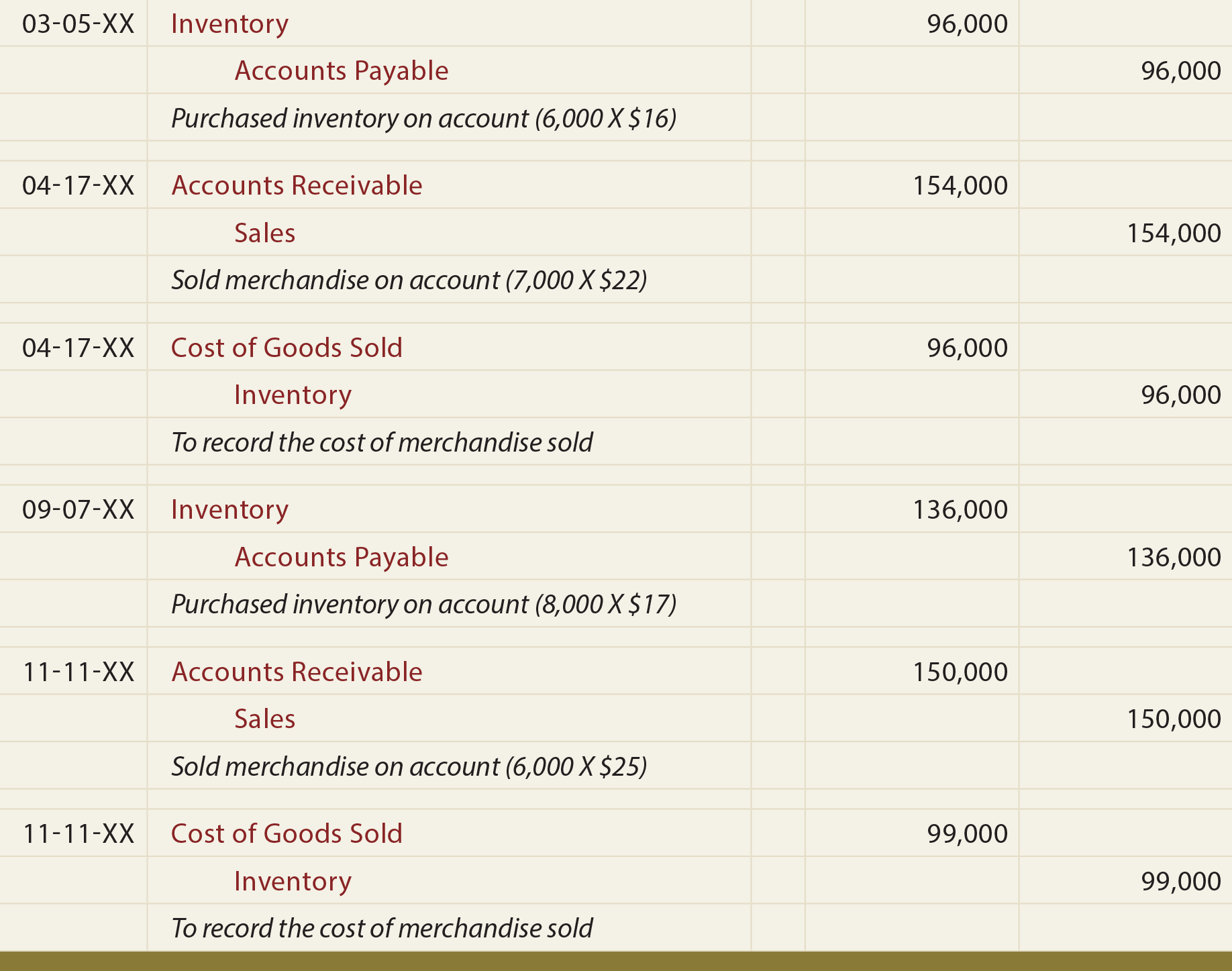

This payment method is available directly from the invoice via a payment button and from the virtual terminal. Wave automatically tracks and records all payments for reporting and tax purposes. Once you have your payments set up, Wave gives you access to its virtual terminal. Click on the “Accept Payments” button at the bottom of the left-hand menu panel to access this feature.

Make it easier for your customers to pay you through a Wave invoice, right from their bank accounts. Wave’s online payments feature lets you accept bank payments, quickly and easily. While Wave provides unlimited invoices, it might be best to look elsewhere if you are looking for more robust account software. Both QuickBooks and Invoice2go offer more comprehensive features like time tracking to easily record billable hours and export them into an invoice. For businesses that carry inventory, QuickBooks Online offers strong inventory tracking that alerts users when the inventory gets low. While Wave offers a basic inventory feature, it does not track stock within the software.

The customer management feature allows merchants to add, edit, remove, and manage customer records. The customer list can be added in bulk or individually from the Add a Customer function or directly while creating a new invoice. Each customer profile includes complete customer contact information and will track every outstanding and paid invoice. While it offers decent customer management and developer tools, it does not support same-day deposits and in-app chargeback management, and its customer support is only available during business hours. Also, while the mobile app can be used to manage invoices, it does not include a POS function. This review explores the potential of Wave as a payment processor for small merchants.