Paypal Makes Use Of Pyusd Stablecoin For First Invoice Cost Fintech Ranking Firm For Fee Gateway Itemizing Directory

This danger is often managed through the audits a platform undergoes to guarantee that Stablecoin Payments reserves match the coins in circulation. The primary good thing about stablecoins is that they get rid of or greatly scale back the volatility of crypto tokens. While this removes them from consideration as investments, it’s a large boon to their use in funds or monetary applications.

Stripe Confirms Plans To Amass Stablecoin Platform Bridge

Additionally, CBDCs can streamline prices and supply a much less expensive alternative to conducting worldwide transactions. USDG will face the uphill task of elbowing into a concentrated market where the two greatest gamers – Tether and USD Coin – account for nearly 90% of the whole market capitalization, according to knowledge from CoinGecko. Federal Bank has setup India’s first QR-based coin merchandising machine. This innovative machine was formally inaugurated on the Federal Bank, Puthiyara Branch, Kozhikode, Kerala. Non- SBI Bank clients could use their own bank Digital rupee wallet to transact with eRupee (Digital rupee).

- Despite the differences in stablecoin structure, design, and risk, all stablecoins require accurate worth data for his or her underlying pegging mechanism and when used in decentralized purposes.

- Japanese banking giants Mitsubishi UFJ Financial Group (MUFG), Sumitomo Mitsui Banking Corporation (SMBC), and Mizuho are embarking on an revolutionary pilot project to revolutionize cross-border funds.

- As digital ledger transactions become more common across industries, Worldpay’s blockchain involvement may pave the greatest way for model new partnerships and income streams.

- Globally, central banks usually use “permissioned” blockchain network implications during which the individuals are limited and must be granted entry to participate within the network and assume about the set of transactions.

Stripe’s Acquisition Of Bridge Validates Stablecoin Use For Cross-border Payments, Says Bernstein

The acceptance of stablecoins might range relying on the specific trade or platform. You can also earn curiosity on usdc and usdt by lending your stablecoins for a set duration. Stablecoins like USDC and USDT can be utilized for multiple purposes, like accessing yield in the blockchain market, storing worth, and making payments. Singaporean startup PEXX has concluded a successful $4.5 million seed funding spherical aimed toward advancing its progressive stablecoin-to-fiat payment platform. The investment, led by enterprise capital firm TNB Aura and supported by early-stage investor Antler and strategic investor EMO Capital, is set to drive transformation in cross-border transactions, the corporate announced.

Paypal Was Granted An Area Crypto License By The Regulator In June Last 12 Months

As stablecoins gain traction as a end result of their capability to attenuate volatility whereas offering the efficiency of blockchain-based transactions, Worldpay is positioning itself to raised serve shoppers in the digital asset space. The company’s transfer to become a blockchain validator may additional integrate it into the rapidly rising crypto and stablecoin ecosystems. According to Sanchit Mall, the company’s Web3 and crypto lead for the Asia-Pacific area, Worldpay is actively exploring opportunities to turn into a blockchain validator.

The Features Of Digital Rupee (e₹) Embody:

The introduction of digital forex represents more than simply the modernisation of the monetary system. The rise of new and emerging applied sciences has also advanced as a strategic crucial to ensure sustainable economic progress. In their pursuit of growing and exploring digital currencies, nations must work carefully with one another and private entities to successfully push the boundaries of expertise. This should, nevertheless, be carried out in opposition to the backdrop of a strengthened cybersecurity regime and a conducive regulatory framework that adapts to the ever-changing customer needs and preferences.

ERupee is a sovereign foreign money issued by Central Banks, in alignment with their monetary coverage, as mentioned in the RBI concept observe. It must be accepted as a medium of payment, authorized tender, and a safe retailer of worth by all residents, enterprises, and authorities agencies. ERupee is freely convertible towards industrial financial institution cash and cash. An instance of that is TrueUSD (TUSD), which uses Chainlink to bring details of collateralization ranges on-chain and give customers a clear understanding of whether their property are absolutely backed. There are varied economic mechanisms that stablecoins utilize to maintain relative stability by holding their peg.

Crypto-backed stablecoins are totally different, in that you have to deposit crypto tokens as collateral into the platform’s good contracts. Finally, algorithmic stablecoins don’t have any reserves, so that they handle supply and demand to take care of steady prices. No. eRupee is digital type of forex notes not like other cryptocurrencies corresponding to bitcoin. ERupee will all the time have similar value as of physical bank foreign money notes which is a legal tender issued by the central bank in distinction to crypto belongings corresponding to bitcoin. Despite their simplicity, stablecoins may be considered to be one of the cryptocurrency industry’s most important innovations, allowing for the seamless transfer of secure worth.

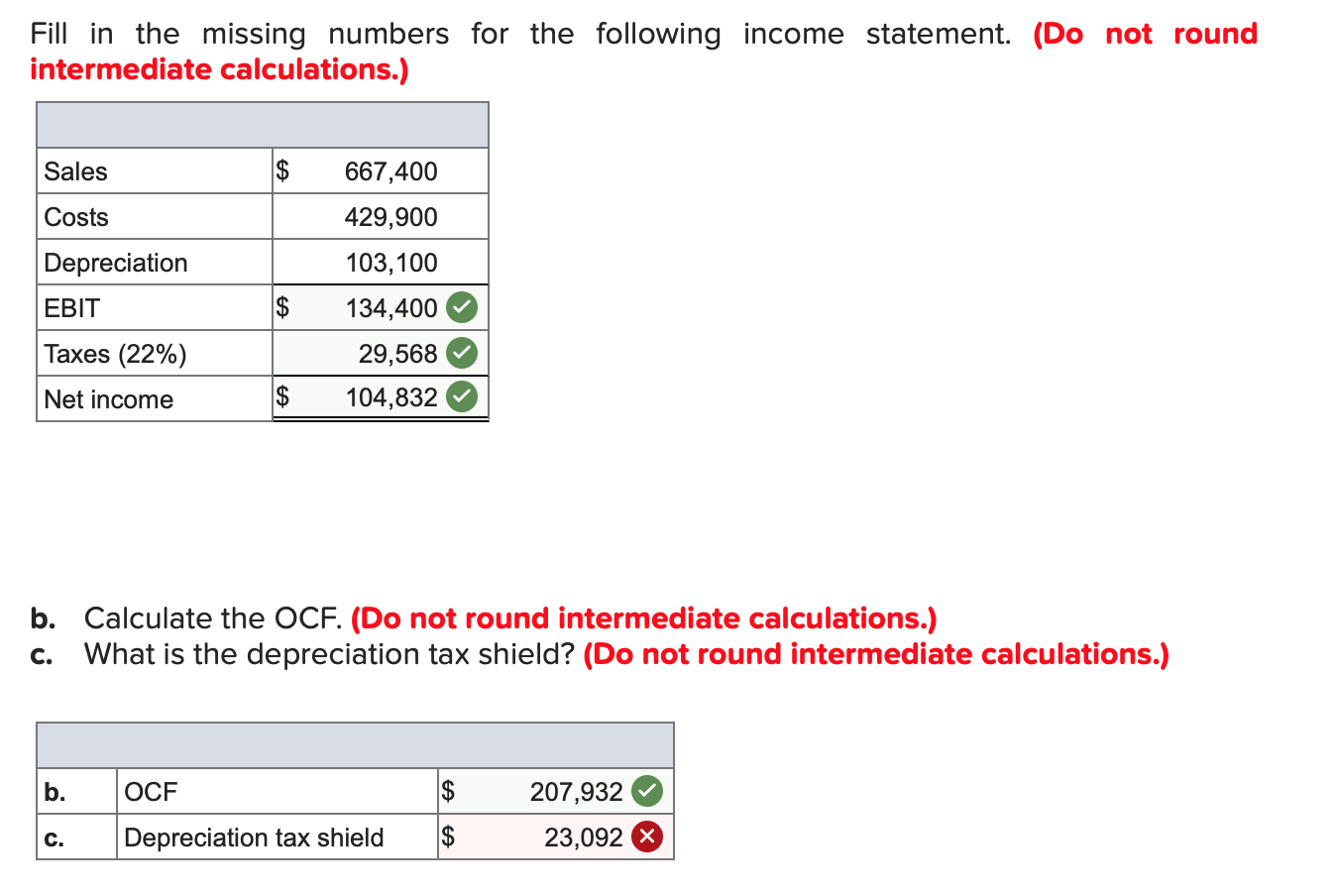

USD stablecoins have a hard and fast worth, which allows merchants a approach to enter and exit positions in the unstable crypto ecosystem. USD-backed stablecoins have gotten the norm, just like how about 90% of foreign currency trading entails the united states PayPal has made historical past through the use of its proprietary PYUSD stablecoin to pay an bill for the first time. The fee was made to Ernst & Young by way of SAP’s digital currency hub, in accordance with a report by Bloomberg. McHenry mentioned in a statement on Monday that PYUSD exhibits that “stablecoins — if issued under a clear regulatory framework — hold promise” for funds techniques.

Paxos may even publish a third-party attestation by an accounting firm on PYUSD’s reserve property. “The imaginative and prescient over time is that this turns into part of the overall funds infrastructure,“ Schulman, who’s preparing to step down in coming months, stated in an interview. However, UPI functions cannot be used to scan and pay through a CBDC QR.

This trend not solely broadens world financing options but in addition fosters enhanced accessibility.” The Qiro team’s acceptance into Alliance’s program is geared toward extending world access to personal credit score through RWAs. Fernandez da Ponte emphasised that the enterprise surroundings is well-suited for stablecoin utilization, particularly for Chief Financial Officers looking for efficient alternate options for international payments. Fungible legal tender for which holders needn’t have a checking account.

Blockchain, also referred to as Distributed Ledger Technology (DLT), converts & shops forex in a digital format to make transactions secure. Cross-border payments have emerged as a key focus area for the G20. You can purchase tokens from the UPI functionality or linked SBI checking account only. Stablecoins are generally backed by reserve belongings like dollars or euros to achieve price stability.

PayPal was granted a local crypto license by the regulator in June final year. Only eligible Federal Bank prospects can use the application from Federal Bank. If you aren’t an existing customer, click on right here to get started and open a hassle free account now in beneath 3 minutes.

Read more about https://www.xcritical.in/ here.